Kraken and Gemini are two cryptocurrency exchanges with ironclad reputations: here’s how Kraken vs. Gemini compare.

Each platform has unique features specifically built for different types of investors. As you’ll learn below, Gemini is better for beginners whereas Kraken is more suited for advanced traders seeking a wider variety of digital assets. The following Kraken vs Gemini comparison goes over the positives and negatives of each exchange, so that you can decide which is better for your needs.

We’ll go over:

- Funding Methods

- Interface

- Trading Fees

- Available Cryptocurrencies

- Transfer Limits

- Company Trust

- Fund Security

- Customer Support

- Conclusion

Kraken vs Gemini: Key Information

| Reviews | Kraken Review | Gemini Review |

| Deposit Methods | Bank Wires, Crypto Deposits | Bank Transfer (ACH),

Bank Wires, Crypto Deposits |

| Available Cryptocurrencies | BTC, ETH, LTC, +14 more coins | BTC, ETH, +26 more |

| Company Launch | 2011 | 2015 |

| Location | California, USA | New York, USA |

| Community Trust | Great | Great |

| Security | Good | Great |

| Customer Support | Average | Good |

| Fees | Very Low | Very Low |

| Website | Visit Kraken | Visit Gemini |

Funding Methods

Gemini allows you to fund your account via bank transfers (ACH), wire transfers, and/or cryptocurrency deposits. Once you put in your request to fund the account, you’re able to start trading right away – even before your transfer is approved. You can’t withdraw any funds until transfer approval, but you can make purchases on coins as the price fluctuates. This is advantageous in a bull market where the prices are expected to increase during the approval process.

Your verification tier determines how you can fund your Kraken account.

At Tier 1, you’re able to deposit and withdraw digital currency only but can trade digital as well as fiat currencies. Tier 1 requires you to submit your full name, date of birth, country, and phone number.

Bank deposit and withdrawals (via wire transfer) are available at Tier 2 or Tier 3 depending on your country of residence. Tier 2 additionally requires your address while you must upload a valid government ID and recent proof of residence to reach Tier 3.

If you’re itching to get started investing, Gemini is much easier than Kraken to get started easiest of the two. Kraken is better suited for investors looking for more advanced trading options and a wider selection of cryptocurrencies.

Interface

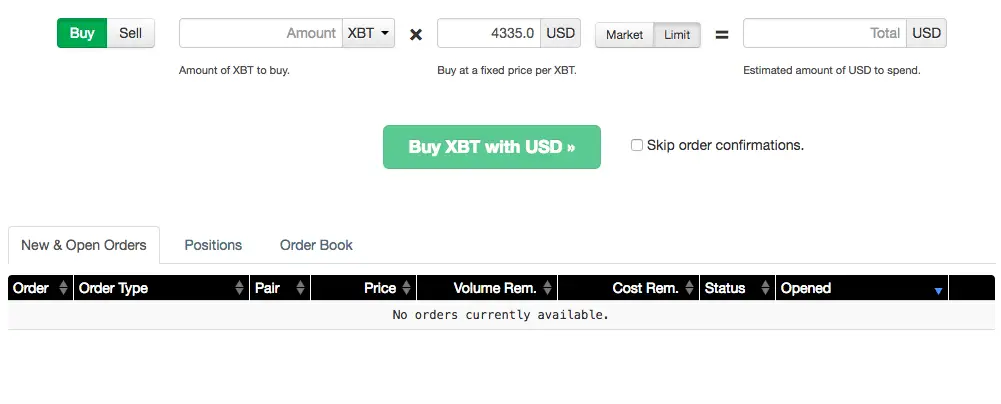

Kraken offers a much more advanced trading experience than Gemini. You can place orders using Simple, Intermediate, and/or Advanced options. Basic market (best market price) and limit (fixed price) orders can be placed using the Simple tab. In the Intermediate and Advanced tabs, you can set stop limits, expirations, leverage options, and conditional closes.

The Gemini platform has a clean design leading to a simpler experience for the average user. The charts sit side by side with the order form enabling you to do analysis as you buy and sell coins – something I value as an investor. One unique feature in Gemini is the ability to order coins in an auction format, although I’ve never tried this myself and wouldn’t recommend it to a new trader.

For experienced investors, Kraken is a better platform to do advanced trading options. If you’re new to investing and your goal is to simply make a purchase and hold it for a while, Gemini is a better choice.

Trading Fees

Gemini and Kraken both have variable trading fees that are determined by your 30-day trading volume and whether you are a maker (putting an order on the books) or taker (filling an order from the books).

The fee for a maker on Gemini decreases from a high of 0.25% down to a rebate of 0.10% as your trading volume increases. With a rebate, your fee turns into a discount that you receive on the trade. For takers, the fee is 0.25% unless trading at the highest volume level.

On Kraken, the maker fee usually ranges from 0.00% to 0.16% with a taker fee between 0.10% and 0.26%.

I recommend calculating what the Gemini trading fees and Kraken trading fees would be on a few trades you’re thinking of performing. Then, you can choose whether or not the difference in fees is enough to outweigh the other factors when choosing your platform.

Available Cryptocurrencies

Kraken supports a multitude of coins and pairings such as:

- Bitcoin

- Bitcoin Cash

- Dash

- EOS

- Ethereum Classic

- Ethereum

- Gnosis

- Iconomi

- Litecoin

- Melon

- Augur

- Tether

- Dogecoin

- Stellar Lumens

- Monero

- Ripple

- Zcash

Gemini only supports Bitcoin and Ethereum trading and has not stated any plans to add more coins.

Clearly, if you’re trying to dive deeper into alternative coin (any coin that isn’t Bitcoin) investing, Kraken should be your choice. Alternative coins, because of their smaller market caps, are inherently more risky investments but can produce larger returns for this same reason. The saying “high risk, high reward” really holds true for these investments.

Transfer Limits

In Gemini, the maximum amount you can transfer via ACH is $500 per day. There’s no limit then depositing using wire transfers and cryptocurrency deposits, though. The Gemini withdrawal limit is $10,000 per day.

Gemini ACH deposits usually take 4-5 business days to be approved. But, as I mentioned earlier, you can use the funds to trade right away.

Kraken has a much higher deposit limit than Gemini with a daily maximum of $25,000 when you provide a proof of source of funds. The withdrawal limit is restricted to $25,000 per day. Kraken deposits take 1-5 business days for approval.

For high volume investors, Kraken’s high daily limits are ideal whereas Gemini is more suited towards lower volume traders looking to quickly get started.

Company Trust

Kraken, operated by Payward, Inc., is located in San Francisco and has received over $6 million in funding from several notable investors including Blockchain Capital. The trading volume on the platform has doubled about every 5 months since its launch in 2013. Growth numbers like this demonstrate the trust that community members share for the exchange.

Tyler and Cameron Winklevoss launched Gemini in 2015 as the first U.S. exchange licensed for bitcoin and ether trading. Even though they’re known for their history with Facebook, the two have been active in the Bitcoin community since early 2013. They’re rumored to own 1 percent of all Bitcoins in circulation and have funded several Bitcoin-related projects through Winklevoss Capital.

Fund Security

Both Kraken and Gemini follow industry best practices when securing your digital funds. However, Gemini takes better precautions in protecting U.S. dollar (USD) deposits with FDIC insurance.

Kraken stores all new coin deposits in cold (offline), encrypted wallets where hackers are unable to reach them. The only digital coins that are kept online are the coins needed to keep operational liquidity on the exchange. There is no mention of FDIC insurance on the Kraken website, but they state that they maintain full reserves to prevent any possibility of a bank run. With no clear FDIC protection, Kraken is a slightly riskier exchange to hold your USD funds.

Gemini doesn’t specify the percentages of assets kept online but ensures that the majority of digital assets are held in their own enhanced cold storage system. Their system guarantees that there’s no single point of failure through the use of secure hardware security modules (HSMs) with multi-signature technology. Gemini holds all U.S. dollar funds in banks that are FDIC insured up to $250,000 per depositor.

Customer Support

While customer support can be non-existent on other exchanges, Kraken and Gemini usually provide good support.

Both exchanges contain a library of FAQs covering common support issues as well as beginner investor questions. Kraken even takes this a step further by providing a comprehensive trading guide to help you get started.

Both companies handle support tickets through email, and Gemini has a typical response time of 2-3 business days. Although I haven’t personally experienced this, Kraken has recently been under fire in many forums for having slow response times and for seemingly ignoring customer support tickets.

Therefore, if you’re a new investor who may need help getting started, I would suggest using Gemini.

Conclusion: Gemini is More User Friendly Than Kraken, But Kraken Has More Functionality

Gemini and Kraken are two significantly different exchanges for significantly different investors.

Gemini, with its simplified interface, is best for new investors looking to do basic trading after a quick account set-up.

Kraken should be used by more experienced investors for high-volume trading and/or alternative coin investing.

(See CoinCentral’s Full List of Crypto Exchange Reviews)

More Kraken Comparisons

- Kraken vs GDAX

- Kraken vs Coinbase

More Gemini Comparisons

- Gemini vs Coinbase

- Gemini vs GDAX

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.