Let’s talk about antifragility: what it is, its consequences and how it relates to bitcoin and the dollar.

The term antifragile was first coined by Nassim Taleb. In the following quote, Taleb outlines the qualities of antifragile systems:

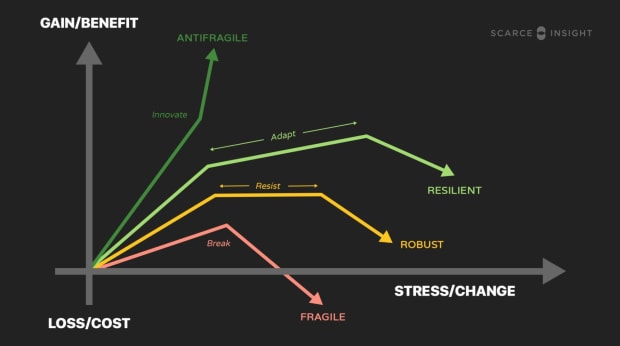

“Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.”

In the context of economics, antifragility suggests economies that are free of government protection, such as tariffs, subsidies and bailouts, are stronger and more efficient than economies that operate with government protection, which are fragile.

Whenever the government props up a company, that company becomes reliant on the government to stay in business. Companies could also begin to behave more irresponsibly, making highly-risky decisions, knowing that if something unfortunate happens, it could always go to the government for help. In a case like this, the government, the economy and the company’s resources are not being allocated to their best use, resulting in a fragile economic system.

To put antifragility in a real-world context, think about the immune system. When your body becomes infected with germs and bacteria, you get sick. But then your immune system strengthens to fight those germs and, on the other end, you have a healthier body. But if you were to stay huddled in your house and never go outside, you would have a fragile immune system and the first illness you encounter could be enough to cause a more serious illness.

The same idea is also true for an economy. An economy operating with government protection is fragile, inefficient and prone to crash. A prime example is the 2008 financial crisis. The 2008 crisis is pretty complicated, so to keep this as simple as possible, let’s talk about how it started. During the housing boom, banks were issuing risky, subprime mortgages because government-backed agencies, like Freddie Mac and Fannie Mae, wanted to buy those mortgages and sell them to investors as mortgage-backed securities. Fannie and Freddie knew these mortgages were risky, but they kept buying them anyway because they were also high-yielding. And Fannie and Freddie knew that if they ever took on too much risk and got into trouble, they could fall back on the government.

But, how does this apply to fragility and our immune system analogy?

Well, think of isolating yourself in your house as the government backing Fannie and Freddie. The more risky investments Fannie and Freddie took in, the more they depended on the government and the more fragile they became to possible shocks. And when that shock came in 2008, they both broke down. Their stock values dropped by more than 99%, several banks they sold securities to went under and millions of Americans lost their homes.

So, the big question: how could antifragility have prevented the financial crisis? If the government wasn’t backing Fannie and Freddie, they wouldn’t have been willing to take on those high-risk loans. Instead, they would have invested in safer loans, like the 30-year mortgage. This would have resulted in more sustainable growth.

But how are the dollar and bitcoin related to fragility and antifragility?

The dollar is in the circle of government control so the government has the power to print and manipulate the currency however it pleases. This is how the Federal Reserve was able to bail out Fannie and Freddie. It just printed the money the agencies needed to stay afloat.

But Bitcoin doesn’t work this way. Bitcoin is programmed to be decentralized and finite, so a single institution can’t gain control of it and print more coins into existence. If the U.S. was operating with Bitcoin, the government couldn’t offer financial protection to anyone. This means businesses would have to behave responsibly to survive because they would understand that there is no government safety net to fall back on. Free market economies are naturally antifragile, but central institutions corrupt the free market by controlling and manipulating the currency and providing favors for well-connected industries and companies. Bitcoin just maintains the natural antifragility of the free market.

In addition to Bitcoin preserving antifragility, Bitcoin is also antifragile in its own nature.

Bitcoin uses open source peer-to-peer technology, meaning anyone with an internet connection can access Bitcoin. So if anyone tries to manipulate the currency, it can be quickly addressed by other people on the network. This is what makes Bitcoin so unique. It operates on a vast network of computers, so anyone can audit its supply and transfers at any time. This is the opposite of fiat currency, which is centrally managed behind closed doors. No one knows if, when or how a fiat currency is being manipulated. We are all simply told to stop asking questions and trust the higher-ups at the Federal Reserve.

Bitcoin transfers that freedom, power and knowledge back to the people. And whenever someone tries to take that power from us, Bitcoin adapts and improves, maintaining its decentralized and finite nature.

This quote by Parker Lewis sums up Bitcoin’s antifragility perfectly:

“While it is easy to fall into a trap, believing Bitcoin to be untested, unproven and not permanent, it is precisely the opposite… each time proving to be up to the challenge and emerging from each test in a stronger state.”

This is a guest post by Siby Suriyan. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.