There are two forward-looking countries on Earth when it comes to Bitcoin: El Salvador and the Central African Republic. These two very different countries on different sides of the globe have both come to the same conclusion: Bitcoin is the best money ever invented and embracing it early will be beneficial both for the people of the adopting nation and to the benefit and preservation of the concept of the nation-state itself.

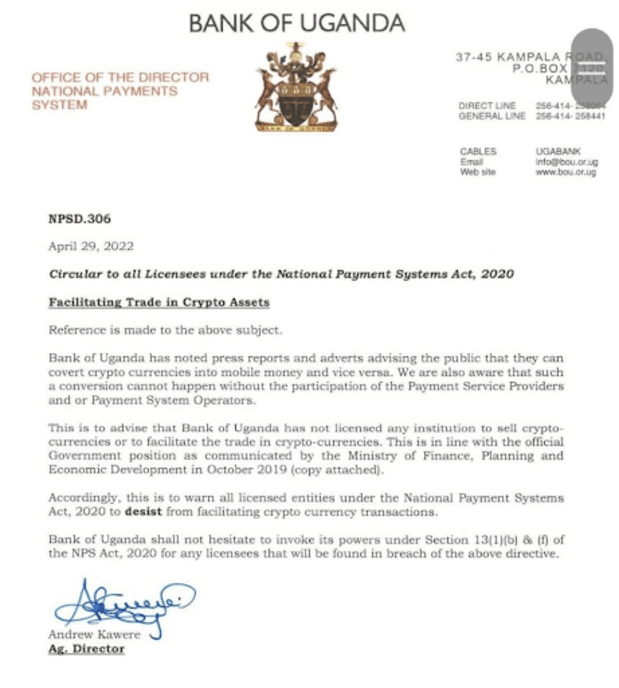

There are other countries on the other hand, that are not led by gifted and insightful people. Uganda may be one such example, the central bank of which has just made this very ill-advised announcement, demonstrating a complete lack of understanding of all the matters to do with money and the great changes that are coming to how it is accounted for.

Their first error is to believe there is such a thing as a “crypto asset.” This term does not describe a real thing and their insertion of this phrase into their announcement shows that their thinking is not original at all, but gleaned from what they’ve read on the internet or what they’ve been told to say by the Bank of International Settlement or the International Monetary Fund.

Compare and contrast with the statements, plans and laws passed by El Salvador, demonstrating a complete understanding of Bitcoin and what it means to the future of that country. There is a clear divide here; on the one hand, profound ignorance and, on the other, deep insight, responsible stewardship, future-oriented thinking and ethics.

Future-oriented governments will be desperate to fully embrace Bitcoin and its dynamics, knowing that the probability that it will become the world’s reserve currency is one. (That means an absolute certainty, math-challenged readers.)

Bitcoin was designed to protect everyone on Earth from stupid people, but before Bitcoin can protect you from stupid people, it needs to be adopted by those same stupid people that are the threat to you. This is the conundrum. How can you get stupid people to buy and hold and use bitcoin? And what happens when they’re running the government?

The answer for people living in ethically-run countries is that people like President Nayib Bukele and President Faustin-Archange Touadéra must take the reins of power and use them responsibly to free their countries from the yoke of penury-entrenching Western fiat currencies.

The Central African Republic is symbolically placed on the continent to become the center of African bitcoin-based ecommerce, being roughly equidistant from all points on the continent. That country could be transformed from being one of the poorest to one of the richest in very short order, should it harness the transformation made possible by adopting Bitcoin and then become a continental hub for Bitcoin. This is no more strange than El Salvador becoming a focus for Bitcoin, for those of you with a goldfish memory who believe this is unimaginable.

Doing business on the continent of Africa is very difficult. It is difficult to get payments in and very difficult to get payments out. For example, there is a black market exchange rate, and the government-sanctioned exchange rate in Nigeria, meaning that there are two economies running in parallel, on top of the difficulty of moving money out. Bitcoin fixes all of this because anyone can send and receive bitcoin in any amount at any time, without permission, and its price is determined by the market, not the State.

Saying “without permission” or “permissionless” as Bitcoiners do, is a phrase loaded with so much benefit that it is hard to describe to Westerners who have no idea of what it is like to do business on the continent of Africa. They take for granted that doing business and sending and receiving fiat money is a matter of pressing a button.

In Nigeria, for example, real life is not so.

Moving money is fraught with difficulties and multiple ways of making a loss on a transfer. These piled-up losses can make it impossible to earn a profit, and if you do, impossible to spend or recycle it where you need to spend or recycle it. Bitcoin makes all of this go away, as well as adding extraordinary speed to all transactions that are without precedent for Nigerians and many people living on the African continent.

Given all of the advantages of Bitcoin, an intelligent person would ask, “Why then hasn’t Nigeria officially embraced bitcoin as a means of payment?” This is the correct question, and there are many answers to this, some cultural, that are preventing the Nigerian government from embracing reality and acting boldly like a leader nation as El Salvador and the Central African Republic has.

Trying to do any sort of Bitcoin business in Nigeria very often involves the invocation of the Central Bank of Nigeria (CBN), which has a stranglehold on all businesses and bank accounts in Nigeria. Bitcoin would abolish their societal status and the reign of terror that they’ve unleashed on the great people of Nigeria. It is a sure bet that this is one of the key reasons why they’re trying so hard to stamp out Bitcoin, rather than do their duty to serve the Nigerian people by embracing this new tool.

That the most populous country on the continent of Africa is the number two nation on Earth for Bitcoin adoption (one-third of all Nigerians use it) in the face of withering and unethical restrictions is a testament to the powerful and resourceful character of the Nigerian people who are born futurists, natural capitalists and extraordinary entrepreneurs: highly intelligent, capable and motivated.

What is holding back the Nigerian people is the totally corrupt, protectionist and anti-Nigeria CBN, which is preventing the flow of money and flourishing of innovation there, for no good reason other than a nauseating lust for power and a cargo cult mentality about the role of the State and necessity for a central bank. In Nigeria, more than any other country “Bitcoin fixes this” by removing the need for the naira from people’s lives as they switch to bitcoin.

Nigeria could become the African capital of Bitcoin if the Nigerian people used it without permission en masse, squeezing out the naira as the people’s money, exposing their businesses and personal finances to the free flow of money bitcoin facilitates. It could become the African capital of Bitcoin with an El Salvador-style embracing of reality if Nigeria made bitcoin legal tender.

Were the Nigerian government to do this, it would be the most powerful signal imaginable, and establish them as the absolute leader nation on the continent. It would not only signal that Bitcoin is changing the world, but that the so called “third-world countries” are taking their destinies into their own hands, opting for sound money over sycophancy, for reliability over rapaciousness, for transparency over tyranny, for clarity over corruption, for freedom over fiat.

The choice is simple. Nigeria must go full Bitcoin by law. The Nigerian people desire and deserve it.

But it appears that the backwards actors and cargo cultists in Nigeria may not presently be prepared to hear these words.

The Nigerian government’s version of a Securities and Exchange Commission, a cargo cult imitation of the American SEC, has just released a totally absurd document on the offering and custody of “Digital Assets.” In it, is one of many hilarious sections on the issuance of initial coin offerings (ICOs) which are already dead everywhere else on earth, and were they not, would never be issued in Nigeria by anyone. This shows that the people who authored this “regulation” are simply copying text from the internet or have been spoon-fed it; in fact, everything about them is copied all the way down.

They even have a totally insane section mandating the publishing of white papers. It is obvious by this that they don’t know the origin of the white paper phenomenon in “the space” and are simply making things up as they go along, regulating and mandating anything that moves without any understanding of how anything works or why it exists.

Remember also, that every novel offering made available over the internet is now fully accessible by every Nigerian citizen, whether the Nigerian government likes it or not, because these offers are freely accessible and usable on commodity mobile phones. All these ridiculous copycat regulations do is ensure that Nigerians are excluded from writing and releasing software inside their own country. And the Nigerian government doesn’t have the technical capability to prevent Nigerians from using Bitcoin or any other communication tool.

In effect, this means that Nigerians (presently one-third of them) are openly rejecting the system there and voluntarily opting into a nongovernmental system of money and finance because it is better and more suited to the Nigerian character of innovation.

To a foreigner, the idea that Nigerians have a character of innovation may seem odd, but there is no other explanation for that great country being number two in the world for Bitcoin adoption. It is the Nigerian government that is Luddite and getting in the way of Nigerians and their inevitable joining of the global network as leaders and peers.

Finally (and thankfully), the position of the Nigerian government appears to be open to change. It is attending the extraordinary meeting in El Salvador with the governments of central bankers from Angola, Armenia, Bangladesh, Burundi, Congo, Costa Rica, Egypt, Gambia, Ghana, India, Namibia, Senegal, Sundan, Uganda, Zambia and 25 other developing countries flying in to find out how to embrace Bitcoin.

Nigeria being on this list of countries is highly significant. As a group, countries on this list are bigger than BRICS. If they all “go Bitcoin,” it will be one of the most significant events in modern history and the removal of the yoke of the dollar from the necks of billions of people.

Bringing them together outside the U.N./U.S. context is a stroke of genius. Now, together with common cause, common complaints and common animus, Bitcoin will serve as the basis for a new pole in the emerging multipolar world: one where financial coordination doesn’t require trust and there is no leader, just the absolutely fair, transparent and totally ethical Bitcoin.

This is a guest post by Beautyon. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.