The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

As the bitcoin price hits another all-time high, let’s dig into the behavior of what older coins are doing on the network. Their behavior helps determine the current state of market sentiment.

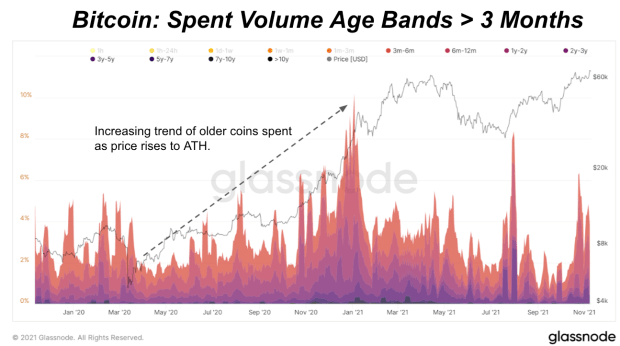

The spent volume age bands for coins older than three months helps to paint a clear picture of what happened at the previous all-time high. There was an increasing trend of older coins (supply greater than three months of age) being spent as price was bid up by new market entrants. The peak in spent volume share during this trend preceded the blow-off top in price back in April.

Since then, that activity has reversed trend with a few small recent events of older coins being spent over the last few weeks. This can indicate strategic profit taking in the market as a one-off type event, or as a potential new increasing trend of more older coins being spent as price rises. This all depends on how the holding conviction of participants has changed this cycle, and finding what levels of higher prices incentivizes more profit taking.

Even with the latest increase to spent volume, the older coin activity is still only 4% of supply being spent, which didn’t have much downward impact on price as it recently broke new highs. Taking a deeper look at coins older than one year of age, the latest spent volume of this cohort is still relatively small at 1.5% of supply compared to over 4% of supply being spent on a consistent basis at the previous peak.

As older coins are spent, they are reset and become younger coins again. We can see that in the HODL waves for supply less than three months old which is starting to show some increases in the one-week to one-month age band.

Historically, the percentage of supply less than three months old will peak with all-time highs during bull market cycle runs. This marks a period where new demand buying and long-term holder selling is exhausted. We’re far from this peak period and currently still at five-year lows.

So far, the older spent volume hasn’t had much impact on this percentage of supply share yet. This indicates that we are just in the beginning stages of more long-term holders willing to sell to new market entrants. Like the bull market cycles in the past, we would expect to see this share of supply rise as olders coins are distributed to new market players.