Throughout history, there has been a cyclical phenomenon characterized by Neill Howe and William Strauss as the four turnings.1 The basic premise of the theory is that civil unrest and major war is cyclical and occurs about every four generations. This is due to the fact that, by the time we reach the fourth generation post-war, society is simultaneously in a state of desiring change yet far enough removed from the atrocities of war that they end up repeating the mistakes of those four generations before them.

As it stands, we are in the fourth turning, the final saeculum before the cycle resets. What’s unique about the fourth turning is that it has historically been an era of destruction, often involving war and revolutions. Based on this theory, it is no wonder we are seeing social unrest. It doesn’t take much browsing of social media or news to see that people want change. People are starting to speak out about the issues within our society: wealth inequality, rising house prices, increasing cost of living, systemic malinvestment and the great concentration of monopolies.

However, as with anything, it can be difficult to decipher the root cause of the issues we face. The millennial generation feels disconnected as it will be the first generation in history to be poorer than its parents.2 The middle class is fed up as it slowly erodes away while asset prices become more unobtainable.3 This unrest is resulting in people voicing their opinions and looking for a way out of this mess. As it stands, capitalism and its lack of governance appears to take the brunt of the blame. As a result, in recent years, people have been more drawn to regimes such as communism or socialism to promote liberation and equality within society (40% of Americans have a favorable view of socialism, up from 36% in 20194). But, this begs the question, is a shift in regime really the best course of action? And is capitalism really to blame?

Before we can answer these questions, let’s first define the various economic systems:5

– Capitalism: “An economic and political system in which a country’s trade and industry are controlled by private owners for profit, rather than by the state.”

– Democracy: “A system of government by the whole population or all the eligible members of a state, typically through elected representatives.”

– Socialism: “A political and economic theory of social organization which advocates that the means of production, distribution, and exchange should be owned or regulated by the community as a whole.”

– Communism: “A political theory derived from Karl Marx, advocating class war and leading to a society in which all property is publicly owned and each person works and is paid according to their abilities and needs.”

From the outset, one could easily conclude that capitalism is incredibly flawed in relation to communism, socialism and democracy as it appears to be focused on private enterprise and profit. On the contrary, communism, socialism and democracy seemingly value the people, liberation and equality. However, if we remove democracy from the equation and take what we have learned from history, we realize that the communist and socialist facade of liberation, equality and a focus on the people could not be farther from the truth. Here are a few historical examples:6

– Mao Zedong, China, 1943–1976 (Socialism): 70,000,000 died by mass murder and government policies (largest death count in history).

– Joseph Stalin, Soviet Union, 1922–1952 (Communism): 28,000,000 died by war genocide and famine (second largest death count in history).

– Adolf Hitler, Germany, 1933–1945 (Socialism): 12,000,000 died by war and genocide (third largest death count in history).

– Kim Jong-il, North Korea, 1993–2011 (Socialism): 2,500,000–3,500,000 (10–19% of the population) died during 1990s famine in part caused by government policies.7

– Pol Pot, Cambodia, 1975–1979 (Communism): 1,700,000–1,900,000 (21–24% of the population) died by government policies and famine.8

– Provisional Military Administrative Council (Communism), Ethiopia, 1974–1987: 1,200,000 died from famine in part caused by government policies.9

It quickly becomes apparent that many of the major genocides, famines and deaths caused by war were all under communist and socialist regimes. Are these regimes really creating a happier and high quality of life economy?

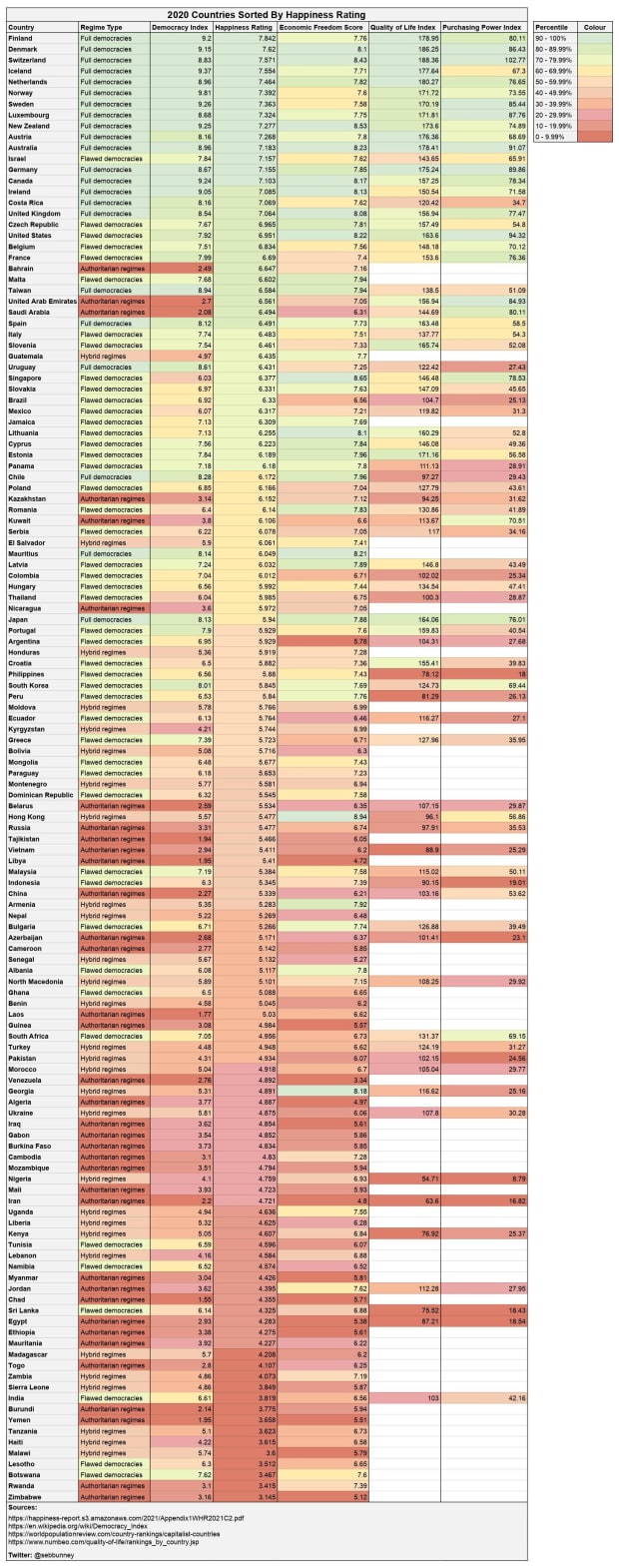

Let’s look at the chart below (sorted by the happiness index, with the happiest nations at the top). There is clearly a correlation between democracies, happiness, freedom, quality of life and currency purchasing power.

2020 Countries Sorted By Happiness Rating Chart10 11 12 13

What is it about communism and socialism that leads to such atrocities, and why do they tend to fail?

Supply and demand: One of the major pitfalls of communism and socialism is that creating a centrally planned economy with the goal of equality, influences the labor force and destroys the natural forces of competition. Inadvertently, this distorts supply and demand. What is forgotten is that through supply and demand, we gain valuable economic insight that allows our economy to error correct, grow and innovate.

Inadequate knowledge and a concentration of power: Within communist and socialist regimes, society tends to rely on the knowledge and experience of an individual or select group of individuals. The central planners believe they understand what is needed to move a country forward. The fallacy in this belief is that humans have many natural biases, such as the need to maintain and secure power, wealth and safety for themselves, their offspring and those closest to them. The result of these biases is that both communism and socialism are prone to authoritarian and totalitarian rule. Once the central planners start to accrue power, they don’t tend to let it go easily. Ultimately, this has led to some of the worst inequality, human rights abuses and social unrest in history. Instead of centralizing power, we should be taking advantage of the population’s collective knowledge.

Suppression of innovation: Communism is built on the belief that we should have a classless society. Although this may appear to be a step forward, diversity among our population prohibits this from playing out as intended. Our society is composed of family-oriented, entrepreneurial, sport-focused and business-minded individuals and we must allow them to explore interests that resonate with them. People are motivated by the belief that they will benefit from the fruits of their labor and this is what creates the perfect breeding ground for creativity and innovation to flourish. When we centrally plan, remove private property rights, and dictate individuals’ careers based on their skills and knowledge, we disincentivize individuals to think outside the box in an entrepreneurial and innovative manner.

Furthermore, innovation doesn’t tend to come from large centralized powers but rather it emerges on the fringe. It is through the free flow of information that creativity and innovation thrive. When we restrict competition and silence people, we end up severely inhibiting innovation and creativity, as this prevents factual, non-mainstream data from percolating to those who can use this information meaningfully. Humanity should promote creativity and innovation as this is how we will solve poverty, climate change, pollution and more.

For these reasons, in the long run, communist and socialist regimes have tended to break down and have led to some of humanity’s worst atrocities. However, no economic system is entirely flawed; otherwise, we wouldn’t see communism and socialism initially implemented. On paper, communism and socialism have many benefits, as both aim to promote security and equality. Socialism, in particular, has given the world universal healthcare, education and welfare. While communism, when effectively implemented, assures that you will have employment when you finish school and eliminates food insecurity. Every economic system has its pros and cons. Thus, we must implement what works, while admitting to ourselves what doesn’t and adapting accordingly.

Where Do Democracy And Capitalism Fall In All Of This?

It can be easy to pin capitalism as the cause for the issues we face due to the fact that all of these issues revolve around the monetary system, and is it not money that drives wealth inequality and capitalist monopolies? However, if we objectively dig a little deeper, capitalism has unfairly been the scapegoat for everything the government doesn’t want to be held accountable for. The reality is that the victims of so-called capitalism are, in fact, the people who have lost capitalism due to increasing governance, regulation and control. In other words, the more control government is given, the more these issues are exacerbated.

The Misdirection Narrative

The notion that our societal and economic issues stem from the government may initially be difficult to believe. The mainstream narrative consistently frames capitalism for the corruption, greed among private corporations, and detrimental monopolies within our economy. However, this is all just a narrative pushed as a form of misdirection. This narrative gives the general population something to blame for the issues we are facing.

Why is this anti-capitalist narrative pushed? The government doesn’t like to relinquish control. You don’t have to spend much time looking through history books to conclude that governments have a lust for control and rarely, if ever, give it up. Therefore, it is not in the government’s best interest to attribute the issues within our economy to its own decision-making. It would only further destroy its population’s faith in government. To better understand this, let’s delve into the various issues we are facing.

Rising House Prices And Cost Of Living

Many tend to attribute increased cost of living to the big corporations raising prices and the escalating house prices to the benefactors of capitalism buying up property. However, the reality is that these are issues with our monetary system. The problem is that the government controls the monetary system via the Federal Reserve and the U.S. Treasury. This gives them some significant benefits, such as regulating who can and can’t use the currency, hidden taxation via inflation and financial repression, and the ability to self-fund without having to offer value (such as it would in a free market capitalist economy). We see this abuse of the monetary system in plain sight. In the last 18 months, 37%14 of all dollars in existence have been created, and the Federal Reserve has purchased 76.4%15 of federal debt. They no longer need to rely on income generated through taxation but rather to just purchase their own government debt.

Ultimately, this allows the government to act in its own self-interest, directing capital to where it feels necessary, which seems to be toward growth at the expense of the economy. It does this via inflation, which is the suppression of interest rates and the injection of capital into our economy to stimulate growth, spending and consumption. The by-product of this tactic is an increase in the money supply, which leads to a rise in consumer prices, cost of living, house and asset prices, and inequality.

Monopolies

Monopolies, in a general sense, are not detrimental to society. They become harmful when they stifle growth and innovation by suppressing competitors in an attempt to maintain their monopolistic position. In a free market, a monopoly is in its position because it adds value to society. Individuals have chosen to purchase their products and services, which allows them to grow and expand. When they stop offering value and/or a superior product or service comes to market, these monopolies are naturally replaced with the newest technology and services.

Unfortunately, this is not the case in our current system. Due to the lobbying environment among most democratic nations, monopolies have the ability to donate large sums of money to politicians and those in power to sway regulation to their benefit. This regulation aids these monopolies by increasing entry barriers and thus reducing competition. Harmful monopolies are not an issue of capitalism, but rather an issue of giving the government too much control and allowing private corporations to influence regulation.

Malinvestment

As people become overly comfortable that the Federal Reserve will intervene during times of stress, we see a rise in excess borrowing and speculative leverage in an attempt to maximize returns. This excess borrowing has two main negative side effects:

1. Excess borrowing creates a surplus of capital in the system. In an attempt to find a home, this capital finds its way into higher risk malinvestments, which leads to amplified fragility in our economy. What would generally be considered a benign market event instead triggers much greater volatility and systemic problems.

2. A zombie company is one that is unable to support itself financially.16 This signifies that the product or service the business offers either does not have enough demand or that the business has been fiscally irresponsible and unable to service its debt. This business should, therefore, restructure or dissolve. With the Federal Reserve backstopping the economy and making it cheaper and easier to access capital, you increase the number of zombie companies in the economy. We should allow the natural life cycle to play out rather than propping up unsustainable companies. When a new business has to compete with an ever-increasing number of zombie companies, it becomes ever more challenging for that business to succeed and prosper. Instead of focusing on innovation, the business must use a portion of its resources to compete. As of July 2020, 19% of listed companies in the U.S. are zombie companies, and this number is rising.17

It should now be evident that the issues we face within our economy today are not to do with capitalism but rather the opposite. They are a by-product of government intervention and control.

What Needs To Change?

No economic system is perfect. Therefore, it is important to avoid getting bogged down analyzing which system is best. Instead, we should focus on what’s within our control to create an economy that prioritizes its people, promotes innovation and encourages creativity. To do so, we must first look at what must change in our current part-democratic, part-capitalistic system:

Monetary system: As should now be apparent, to reduce the centralization of power, the negative by-products of inflation and systemic malinvestment, we must separate the monetary system and the government. Doing so removes the government’s controlling capabilities, ensuring they act as a service provider with the population’s interests at heart. If the government is not acting in the best interest of the population, it will not receive capital in the form of taxes and will be unable to fund itself. Additionally, removing the monetary system from the clutches of government would allow a monetary system chosen by the people to emerge, one that is not corrupted by those in power and allows the true deflationary state of the world to surface.18 As Aaron Segal concisely states, “deflation is a measure of success in creating economic value as innovation creates more for less.”19

Transparency: Nations fail when there is a lack of trust in government, resulting in coups and revolutions. The fastest way to break trust within a nation is to remove transparency. One of the major flaws we face today is a lack of transparency. If we promote transparency within our economic system, we can rebuild trust amongst the population and the government. This will help drive the economy forward by reducing our wasted productive energy spent fighting amongst ourselves.

A Potential Solution

It can be difficult to separate democracy and capitalism, as they have generally been intertwined throughout history. One could go as far as to say that we have never seen a true capitalism-based economy. This makes it challenging to pinpoint the benefits democracy has brought to the table and likewise for capitalism. However, if we want to promote innovation, productivity, sustainable growth and freedom moving forward, it is in our best interest to adapt as an economy and take on benefits from the various regimes:

Socialist welfare/healthcare/education: We live in a world of inequality. Individuals enter this world disadvantaged, and we have unforeseeable events that take a toll on our lives. Whether this is on a monetary, health or educational level, it is a fact of life. Thus, we must have access to resources that allow us to feel a part of society and obtain the necessary assistance to grow and thrive. With this in mind, the best option would be to adopt the socialist welfare, healthcare and education system, ensuring everyone has access to these core amenities.

Decentralized democratic decision-making: Democracy is essential to ensuring that the general population has a say in political decision-making. However, we must ensure that this doesn’t result in a concentration of power, lack of transparency or the potential for bad actors. To promote transparency and take advantage of the collective knowledge, we should focus on the decentralization and dispersion of centralized government power down to the lower state, municipal and individual levels. This would ensure that more people would have a say in how our country is run and that regulation is upheld.

Capitalist free market: The capitalistic free market is an incredible source of creativity and innovation. It rewards individuals for putting themselves on the line and bringing their ideas to life. Additionally, free market capitalism promotes natural supply and demand, allowing us to extract crucial economic information, error correct more effectively and thrive as a nation.

Bitcoin

How can Bitcoin play a role in all this? Bitcoin offers a way to bridge democracy and free market capitalism by providing a true decentralized currency that is:

– Permissionless: No one is excluded from using bitcoin. There is no gatekeeper deciding who can and can’t use it.

– Open-Source: Bitcoin’s source code is open-source, allowing anyone the ability to read, propose a modification, copy or share.

– Pseudonymous: Since no ID is required to own and use bitcoin, this ensures privacy for individuals.

– Fungible: All coins are treated as equal and should be equally spendable.

– Immutable: Confirmed blocks/transactions are set in stone and, therefore, cannot be changed at a future date.

– Fixed Supply: With a fixed supply of 21 million coins, bitcoin is proving to be one of the best stores of value due to its inability to be devalued through supply expansion. This is key to providing accurate supply and demand data.

Bitcoin has the potential to remove the monetary system from the clutches of the government, allowing us to operate a true capitalistic free market. This would enable us to obtain accurate supply and demand information, allowing our economy to grow, innovate efficiently and error correct. Bitcoin would also give the general population security, knowing that their hard-earned savings will not fall victim to inflation.

Additionally, Bitcoin gives us a great example of the power of decentralization. If we can take what we know from Bitcoin’s decentralized blockchain, we can greatly increase transparency within our economy. Two areas which may benefit the most are:

Government: By implementing a decentralized blockchain within the government, we can increase transparency and remove the potential for self-interested bad actors. Furthermore, promoting decentralized transparency would allow everybody access to accurate, immutable consensus data, decision-making and economic information. That way, individuals and the government could better use this information to innovate and progress.

Decentralized Autonomous Organizations (DAOs): Just like other economic systems, free market capitalism still has the potential for bad actors. By using blockchain technology, we can build the next generation of organizations using the DAO framework based on open-source code. Furthermore, without a typical management structure or board of directors, we are able to operate decentralized organizations. This gives investors a real say in the direction of the organization and gives the public transparency regarding the organization’s goals and motives.

Conclusion

It should now be clear that many of the reasons individuals are pushing for communism and socialism are not due to flaws in capitalism but rather increasing governance, regulation and control. Looking back throughout history, if we give way to these propositions, the consequences may be detrimental — the fallacy to consolidate and centralize power has led to some of mankind’s darkest days.

Instead, we should step back and look at capitalism and the other economic systems from a more holistic viewpoint. Let’s take the welfare/healthcare/educational support system from socialism, implement democratic decision-making, and give more power back to the people to let free market capitalism run its course. By doing so, we may be able to resolve many of the issues we currently face.

Lastly, instead of pointing fingers at capitalism, we should be educating people about the benefits that it has brought to our economy in the form of increased innovation, private property, privacy and human rights.20 Furthermore, we should be trying to better integrate new technology such as Bitcoin into our ever-evolving economy.

Humanity is in the middle of a turning point where it is shedding much of the old inefficient technology and practices and making room for the new era. With this in mind, we should be focusing on what matters. Let’s come together and build the economy we want to see tomorrow instead of directing our energy toward each other in the form of aggression and criticism. As Thomas Jefferson once said, “I predict future happiness for Americans, if they can prevent the government from wasting the labors of the people under the pretense of taking care of them.”

This is a guest post by Sebastian Bunney. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

Endnotes

1 Howe, Neill, and William Strauss. “The Fourth Turning.” Crown Publishing Group, 1996.

2 Lowrey, Annie. “Millennials Don’t Stand a Chance.” The Atlantic, 2020,

https://www.theatlantic.com/ideas/archive/2020/04/millennials-are-new-lost-generation/609832/.

3 PEW Research Center. “Trends in Income and Wealth Inequality.” PEW Research, 2020,

https://www.pewresearch.org/social-trends/2020/01/09/trends-in-income-and-wealth-inequality/. A

4 YouGov. “Fifth Annual Report On U.S. Attitudes Toward Socialism, Communism, and Collectivism.” Victims of Communism, 2020, https://victimsofcommunism.org/annual-poll/2020-annual-poll/.

5 Oxford Languages. “Dictionary.” OxfordLanguages, 2021, https://languages.oup.com/google-dictionary-en/.

6 Johnson, Ian. “Who Killed More: Hitler, Stalin, or Mao?” ChinaFile, 2018,

https://www.chinafile.com/library/nyrb-china-archive/who-killed-more-hitler-stalin-or-mao.

7 Wilson Center. “How Did the North Korean Famine Happen?” Wilson Center, 2002,

https://www.wilsoncenter.org/article/how-did-the-north-korean-famine-happen.

8 Kiernan, Ben. “The Demography of Genocide in Southeast Asia: The Death Tolls in Cambodia, 1975-79, and East Timor, 1975-80.” Taylor & Francis Online, 2010,

https://www.tandfonline.com/doi/abs/10.1080/1467271032000147041.

9 Gill, Peter. “Famine and Foreigners: Ethiopia Since Live Aid.” SAHistory, 2010,

https://www.sahistory.org.za/sites/default/files/file%20uploads%20/peter_gill_famine_and_foreigners_ethiopia_sin cebook4you.pdf.

10“Capitalist Countries.” World Population Review, 2021,

https://worldpopulationreview.com/country-rankings/capitalist-countries.

11 Economist Intelligence Unit. “Democracy Index.” Wikipedia, 2020, https://en.wikipedia.org/wiki/Democracy_Index.

12 Helliwell, John. “World Happiness Report.” Happiness Report, 2021,

https://happiness-report.s3.amazonaws.com/2021/Appendix1WHR2021C2.pdf.

13 Numbeo. “Quality of Life Index by Country.” Numbeo, 2020,

https://www.numbeo.com/quality-of-life/rankings_by_country.jsp.

14 FRED. “M2 Money Stock.” FRED, 2021, https://fred.stlouisfed.org/series/M2SL.

15 Gramm, Phil, and Thomas Saving. “How the Fed Is Hedging Its Inflation Bet.” Wall Street Journal, 2021,

https://www.wsj.com/articles/federal-reserve-powell-mmt-inflation-debt-price-stability-money-supply-11627845307

16 Bunney, Sebastian. “Why More Isn’t Better.” Bitcoin Magazine, 2021,

https://bitcoinmagazine.com/culture/when-more-isnt-better-money-inflation.

17 Sharma, Ruchir. “The Rescues Ruining Capitalism.” The Wall Street Journal, 2020,

https://www.wsj.com/articles/the-rescues-ruining-capitalism-11595603720.

18 Booth, Jeff. “The Price of Tomorrow.” Stanley Press, 2020.

19 Segal, Aaron. “Bitcoin Information Theory.” Bitcoin Magazine, 2021,

https://bitcoinmagazine.com/culture/bitcoin-information-theory-bit.

20 De Soto, Hernando. “The Mystery of Capital.” Basic Books, 2000.