DeFiChain is a decentralized proof-of-stake blockchain that is specially dedicated to decentralized financial applications.

As a fork of Bitcoin’s blockchain, DeFiChain allows DeFi applications (dApps) to implement more advanced through custom transactions, also known as DeFi Transactions (DfTx).

There are loads of DeFi platforms out there – but many don’t support Bitcoin. This is an issue, as many people trust the first token more than any other.

What is DeFiChain?

As many businesses have still been suffering from the global pandemic as well as the attack of Russia on Ukraine, more people are taking interest in participating in the financial market such as the stock or crypto markets in an effort to protect their assets.

These market forces to push blockchain technology-based decentralized finance services to take off to new and exciting heights.

However, platforms like Bitcoin still have known existing problems in terms of scalability and decentralization that could stint the growth of DeFi on the Bitcoin blockchain.

DeFiChain is an innovation that offers possible solutions to these problems.

It is designed to bring financial services such as borrowing, lending, investing, saving, and everything else that a commercial bank can do into the decentralized Bitcoin market.

DeFiChain provides high transaction throughput, reduced risk of errors, and intelligent features to create a reliable alternative form of financial services built on top of Bitcoin.

The blockchain makes investing exciting by offering your entire investment portfolio in the palm of your hand.

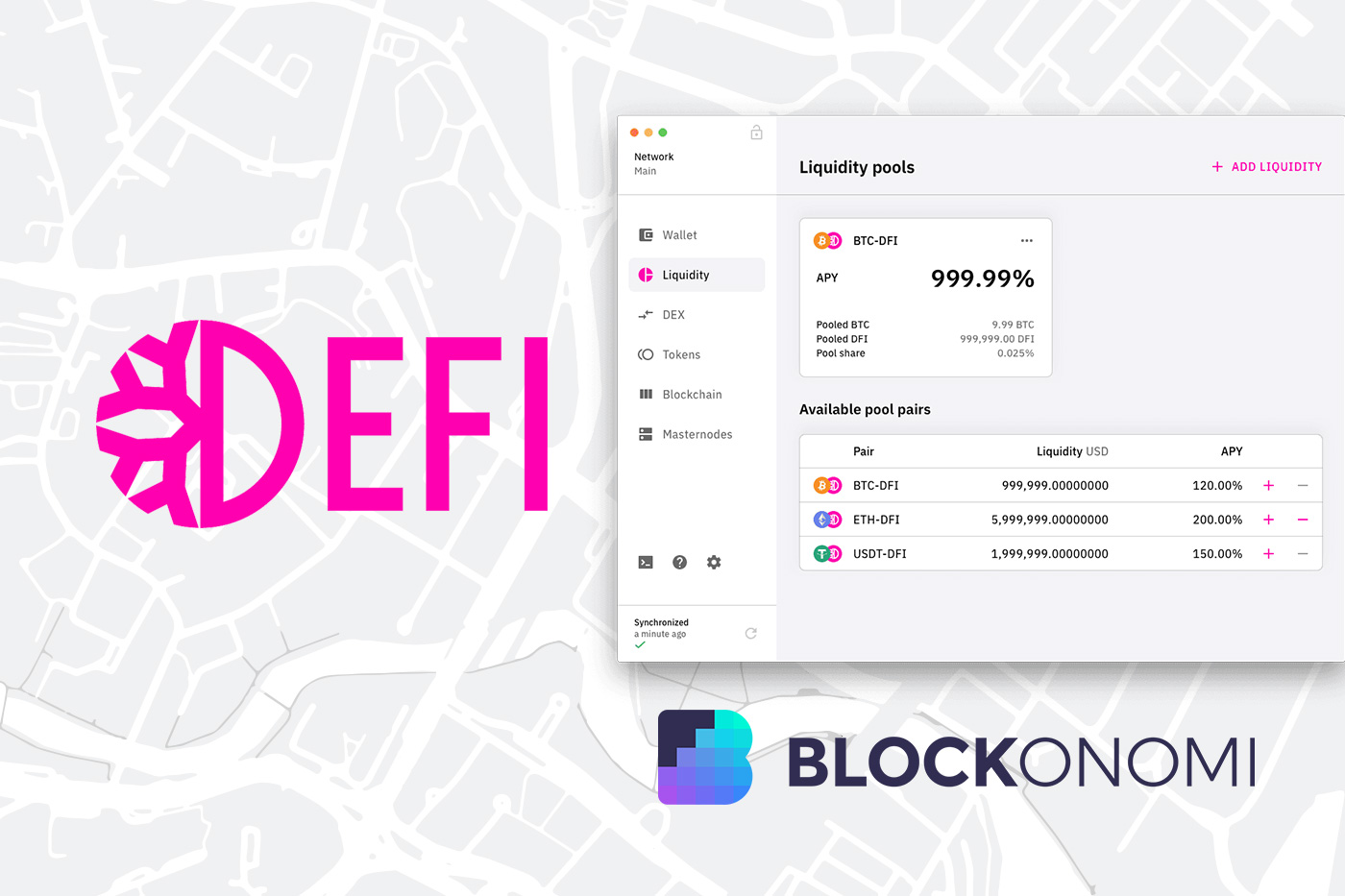

There’s a range of services that you can find in DeFiChain including Liquidity Mining, Staking, decentralized stocks, and decentralized loans.

All of these services are similar to MakerDAO but add more functionality such as minting stock tokens and stable coins against collateral.

DeFiChain – The Entrance to The World of Bitcoin DeFi

If you are a blockchain-lover, Bitcoin and Ethereum are not strange to you.

Both blockchains are two of the world’s biggest and most common blockchain networks.

While Bitcoin is the oldest blockchain network, Ethereum is the first one that allows apps to be built on top of it.

However, these blockchains still have severe limitations. Although Bitcoin’s highlight is its security which demonstrates its impermeability to attack hackers, it cannot do more than simple transactions of bitcoins between two parties.

Ethereum allows developers to build applications that can execute more complex transactions, but it cannot scale to accommodate an increasing number of on-chain activities when demand increases.

DeFiChain, meanwhile, is able to solve for scalability, security, and fair governance to continuously improve the network.

To provide immediate security, DeFiChain will anchor itself to the bitcoin blockchain. In this way, the blockchain is always fully secure and immutable.

Unlike Ethereum or other blockchains, DeFiChain uses a different consensus protocol known as Proof of Stake (PoS), which is more energy-efficient and offers the ability to create a variety of dApps based on one chain rapidly with a very low attack surface.

DeFiChain’s approach to dAssets is very strong compared to the competition. It delivers a constantly increasing amount of assets, which is very easy to use via the mobile wallet, as well as, offering the best yields.

Designed for investors in the cryptocurrency market who are interested in finance opportunities to make their cryptocurrency work just like any other form of capital beyond just buying and holding cryptocurrencies.

These innovations allow users and developers to ensure a return on investment and also enjoy passive income.

The biggest market is the European market with a majority coming from German speaking countries such as Germany, Austria, and Switzerland.

DeFiChain Key Functionalities

DeFiChain is a non-Turing-complete blockchain.

As mentioned, the blockchain is designed specifically for decentralized finance dApps. Therefore, it provides full simple, rapid, and secured functionalities for this specific segment.

These include the following:

- Decentralized lending

- Decentralized wrapping of tokens

- Decentralized Pricing oracles

- Decentralized exchanges

- Transferable debts and receivables

- Decentralized Non-collateralized debt

- Asset tokenization

- Distribution of Dividends

To date, DeFiChain has achieved many milestones since its launch. The most prominent has been the Fort Canning update that brought decentralized assets to DeFiChain.

As a result, investors are able to buy, hold and sell decentralized tokens which mirror the price of real stocks, indices, and commodities on the chain.

The upgrade also allows implementation of a native decentralized stable coin dUSD. DeFiChain users can lock collateral including dBTC, dETH, dUSDC, dUSD to mint stock tokens, and dUSD.

Thanks to low volatility, this can bring low impermanent loss and high rewards to you.

$DFI Coin

The $DFI is an integral unit of account in the DeFiChain ecosystem.

$DFI is used primarily as a fee for transactions and governance on improvement proposals on the chain.

In addition, the coin is also used for the creation of new tokens on DeFiChain (DCT) and for submitting community proposals.

The DeFiChain Foundation will be issuing the DeFi utility token, DFI, capped at 1,200,000,000 (1.2 billion) throughout its lifetime. Only 1.2 billion DFIs will be created.

DeFiChain is a community project. There is no Initial Coin Offering, only free airdrops.

DFI is used for fee payment for all transactions and smart contracts on DeFiChain including fee payment for decentralized exchange transactions, fee payment for token transfers, fees payment for DeFi activities, DEX fees, ICX fees.

Besides, DFI can be used as collateral for borrowing other crypto assets on DeFiChain. It will need 20,000 DFI to run a staking node for DeFiChain, 100 DFI to create a DeFi Custom Token (DCT), which is refundable upon the destruction of the DCT, 10 DFI for Community Fund Proposal, and 50 DFI for a Vote of Confidence.

Users are going to receive rewards from minting a block on DeFiChain.

How to Get Started With DeFiChain

DeFiChain is an easy-to-use platform with features available on the mobile wallet.

You will need to buy the $DFI token first which is available on platforms like KuCoin, Bittrex, DFX, and many more. Then send it to your wallet.

Within the wallet, you can use DFI to buy assets like dTSLA tokens and can either go long or put them in a liquidity pool to earn rewards.

This also works with other common cryptocurrencies in the market like dBTC, dLTC, dETH, or which are paired with DFI.

Currently, the feature of sending native tokens such as BTC or ETH to the DeFiChain wallet is not available.

Instead, the process will work through CakeDeFi, a company that offers services like Staking, Liquidity Mining, and Lending. However, users can buy dTokens of other cryptocurrencies on the mobile wallet.

Users with 20.000 DFI can set up a Masternode and stake their coins in a decentralized manner. Others can use staking pools like CakeDeFi or DFX swiss.

DeFiChain Changes The Future of Finance

DeFIChain is the only Blockchain that offers decentralized assets on Bitcoin as of now.

With the new decentralized futures and options is expected to come in later this year, DeFiChain will be the only blockchain to offer such a feature.

dAssets are a truly amazing feature since they can be expanded unlimited to mimic any kind of investment.

From stocks, indexes, ETFs, Fonds to precious metals. You are able to re-build your complete investment portfolio on DeFiChain. With liquidity mining, you are also able to earn rewards.

DeFiChain can be accessed by everybody from everywhere. It offers assets to everybody without limitations.Because it is a very young project the rewards for staking and liquidity mining are also quite high still.

To learn more about DeFiChain – please click right here!