After the market turmoil that brought massive pain to numerous crypto-related companies, FTX continues to channel money into such entities.

The latest one in which the SBF-spearheaded organization will acquire a large stake is SkyBridge Capital.

- According to a CNBC report from earlier on September 9, FTX Ventures will take a 30% stake in SkyBridge Capital.

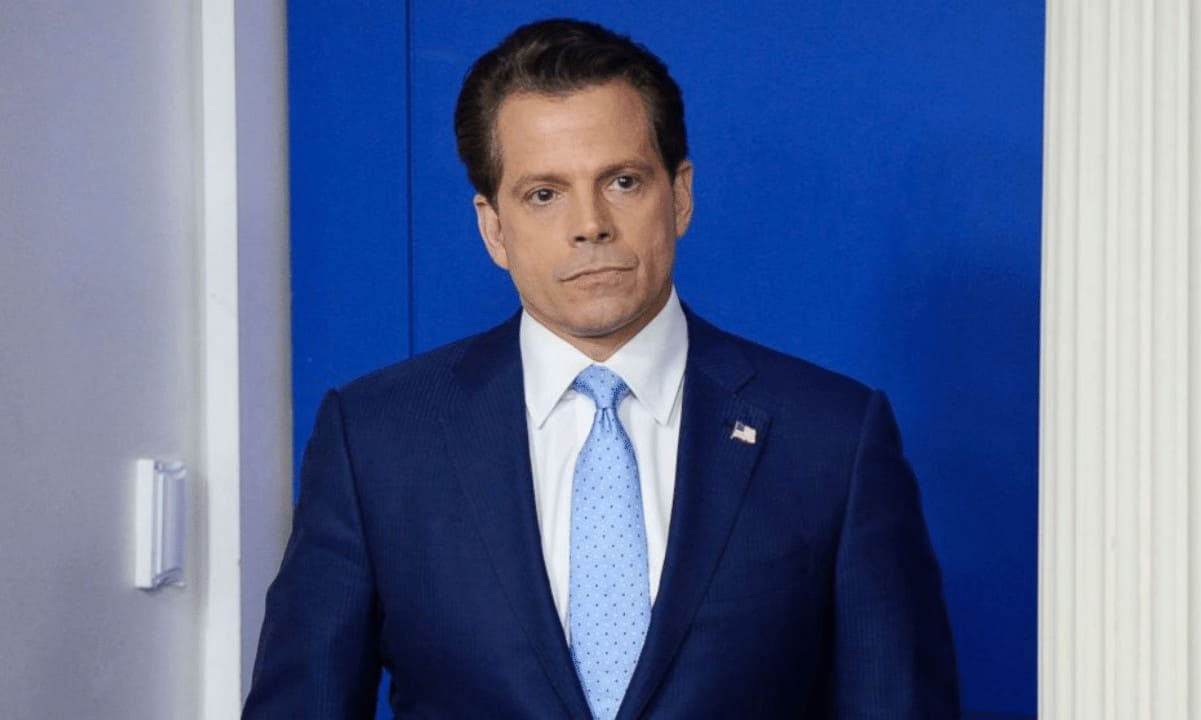

- The leaders of the two entities – Sam Bankman-Fried and Anthony Scaramucci, are set to provide further details on the deal later today.

- SkyBridge will reportedly use a portion of the funds (around $40 million) to pay old investors and strengthen its balance sheet.

- The firm began struggling due to its substantial exposure to the cryptocurrency industry after the market sank a few months ago.

- As such, its flagship fund, as well as other company products, saw a significant investor exodus, as reported before.

- SkyBridge also had to pause withdrawals for one fund that actually had exposure to FTX.

- Scaramucci later admitted that going so big on bitcoin and the entire industry could have been a short-term mistake.

- FTX, on the other hand, has been on a buying/investing spree in the past few months, offering to acquire portions in many of the struggling companies, such as BlockFi and Voyager Digital.