Mining is a popular way to earn BTC, but is investing in mining equipment worth it? To answer this question, it’s good to look at both long-term and short-term costs and opportunities. This article covers general factors to consider at any point in time and a specific example based on the value of BTC in 2019.

Upfront and Continuing Costs

The question of how much Bitcoin miners make is complicated. There are several key factors that go into determining profitability. Although there might be other things to consider, here’s a short list you should be aware of.

Hardware Costs and Capabilities

The costs of mining equipment can vary greatly. From less powerful CPU rigs to high power ASIC miners, this is the largest upfront expense. While going with a cheaper rig might save money upfront, you will likely earn less BTC (or other cryptocurrencies) over time when compared to the more expensive options that are capable of producing faster hash rates.

Electric Costs (Location, location, location)

One of the biggest challenges to determining precise Bitcoin mining profitability is a mining operation’s geographic location. Places that have high electric costs and warmer environments can make it much harder to achieve a solid ROI. Locations with cheaper electric costs and cooler environments at least make profitability a possibility. Typically, places that have an abundance of hydroelectric energy, for example, have more large-scale mining operations. However, local laws implemented in recent years throughout many jurisdictions prohibit Bitcoin mining altogether.

Setup Time and Ongoing Hardware Costs

Since investing money into mining rigs can be quite expensive, one might assume that the setup process is quite easy. This is not the case. The reality is that you must be highly tech savvy to assemble rigs and maintain them over time. For many miners, the fact that Bitcoin hasn’t undergone any major mining algorithm changes presents some stability over other cryptocurrencies that have.

Whenever other crypto projects have changed to ASIC-resistant algorithms, mining rigs valued at thousands of dollars oftentimes become incapable of mining. Nevertheless, Bitcoin’s maintained support for ASICs means that miners are more likely to have to pay more per mining rig.

Mining Difficulty and Competition

Even in bear markets, there is some good news. Generally, lower BTC prices lead to less competition among Bitcoin miners. The bad news is that people wanting to immediately convert back to fiat would probably do so at a deficit. Therefore, mining is generally better for those that are willing to HODL during bear markets.

On the flip side, bull markets bring on more competition, which generally means fewer BTC per miner. Nonetheless, there is a good possibility of converting back to fiat at a profit during these times.

Varying Fiat Values and Crypto Values

The term ‘profitability’ is relative. Of course, the value of BTC can fluctuate wildly. However, it’s also important to recognize the cost equivalents in your local fiat currency. In many instances, high inflation of fiat currencies might mean that you are able to reach relative profitability sooner. Then, there are additional, complicated questions to ask yourself. For instance, do you plan on using BTC mining rewards immediately to purchase things? Do you HODL crypto in hopes of higher values later on? Do you want to immediately convert back to fiat?

Halving Events

Bitcoin has a mining reward that is designed to reduce by half at certain blocks. In 2019, Bitcoin miners receive 12.5 BTC each time they successfully mine a block. By the end of May 2020, the next halving event should occur. When this happens, the mining reward will only be 6.25 BTC.

[thrive_leads id=’5219′]

How Much Do Bitcoin Miners Make in 2019?

Considering general, long-term costs and profitability (featured in the section above) are important. Still, people want to understand what profitability looks like in the short-term. The simple answer is that BTC profitability (as of late April 2019) is bleak. This is due to the relatively low value of BTC when compared to that of the previous bull market of 2017. Of course, this could always change at any point in time if the value of BTC were to increase. To put 2019 profitability into better perspective, it’s good to use a real-world scenario based upon realistic factors.

Scenario 1

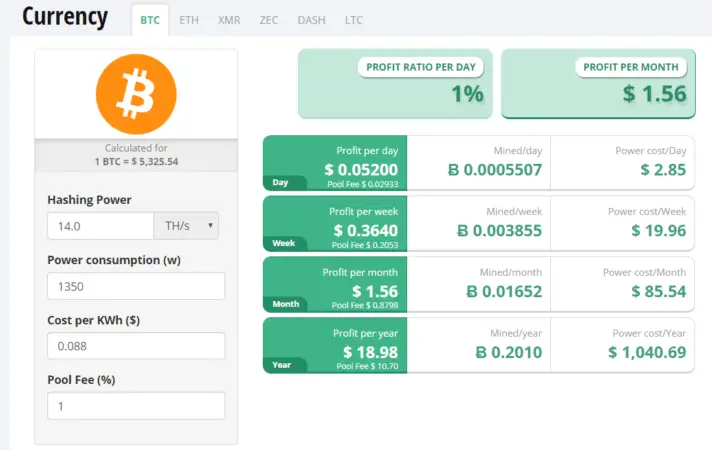

In this scenario, let’s say a miner wanted to use the Bitmain Antminer S9. Note that by changing to a different mining rig, the results will vary but just slightly. The Antminer S9 has a higher hash rate (14.0 TH/s) and power consumption of 1350 W than many competitors.

As most crypto miners do, it’s likely that you would join a mining pool. Fees with this can vary, but one percent is considered to be standard.

Finally, the cost of electricity is the most vital expense to factor in. If we look at states within the US, for example, net returns or losses depend heavily on these rates. Oklahoma, for instance, has the lowest average electric cost at $0.088 kWh as of January 2019. Based upon April 2019 BTC prices, it would take some time to get any return on investment.

Although this calculation in the graphic below shows an estimated return of $1.56 per month, it doesn’t include the cost of this particular mining rig (~$3,000). Assuming that BTC prices remained the same (~$ 5,325), it would take over 162 years to get to profitability, even in the place with the cheapest electric costs in the US. This doesn’t even factor in the possibility of rising electric costs over time.

Scenario 2

In Scenario 2, let’s keep all of the above factors in Scenario 1 the same besides location/electric cost. By opting to mine in Hawaii, the state with the most expensive electric costs at an average of $0.3209 KWh, you would be running a deficit of $224.82 per month. This doesn’t even include the cost of the mining rig. Thus, it would be nearly impossible to reach profitability in Hawaii, even if the value of BTC increases significantly.

Return to Mining Profitability?

Even in the ideal location with a high-quality mining rig, it’s clear that reaching profitability in a reasonable amount of time via BTC mining is practically impossible to accomplish (at least as of early to mid-2019). However, this doesn’t mean that this will always be the case.

If a bull run occurs, those who were able to successfully mine BTC will have a chance to get a return. Still, this can be difficult to predict. In summary, if you’re looking to get a short turnaround on ROI, it’s probably best not to consider BTC mining. Still, there is always potential that BTC value could return to previous highs, making mining profitable in the long-term.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.