There’s no denying the fact that the crypto market has continued to grow from strength to strength over the course of 2021, as is best showcased by the fact that the sector as a whole has seen its value triple from $1 trillion to $3 trillion within a span of the last 9 months. Not only that, even the innovation that has come about as a result of this rapid expansion has been staggering, to say the least.

For example, the core concept underlying non-fungible tokens (NFTs) seems to have really piqued the interest of investors around the globe. Similarly, even the decentralized finance (DeFi) sector has grown to become a full-fledged market in itself over the last couple of years, thus showcasing the tremendous possibilities put forth by crypto.

NFTs, in particular, are a class of digital assets, that continue to draw people to them each passing day since these offerings present owners with digital receipts representing ownership of literally any asset under the sun — be it physical or digital — such as paintings, JPEG files, pieces of music and even real estate.

In terms of how much the non-fungible token market has blossomed, during Q3 of this year alone, the total sales of these novel cryptos rose as high as $10.7 billion, something that was recently put on display when a growing list of celebrities including rapper Jay Z, NBA superstar Stephen Curry, thrash metal pioneer Dave Mustaine, amongst many others, showcased their support for these offerings.

Here’s why it may be time to move on from OpenSea

As things stand, the NFT market is controlled by the whims of a few centralized platforms, one of whom is OpenSea, a digital hub where users can trade and mint NFTs with relative ease. However, recently, a number of issues have continued to arise in relation to the platform resulting in a major loss of customer confidence.

For example, earlier this year in September, it came to light that an OpenSea employee had been using non-public, sensitive customer-related information to dabble in insider trading showcasing the centralized aspect of the platform. Similarly, a month or so ago, a blockchain security firm noted that certain flaws in OpenSea’s native design could potentially enable nefarious third-party hackers to “steal one’s entire crypto savings” via the use of malicious NFTs.

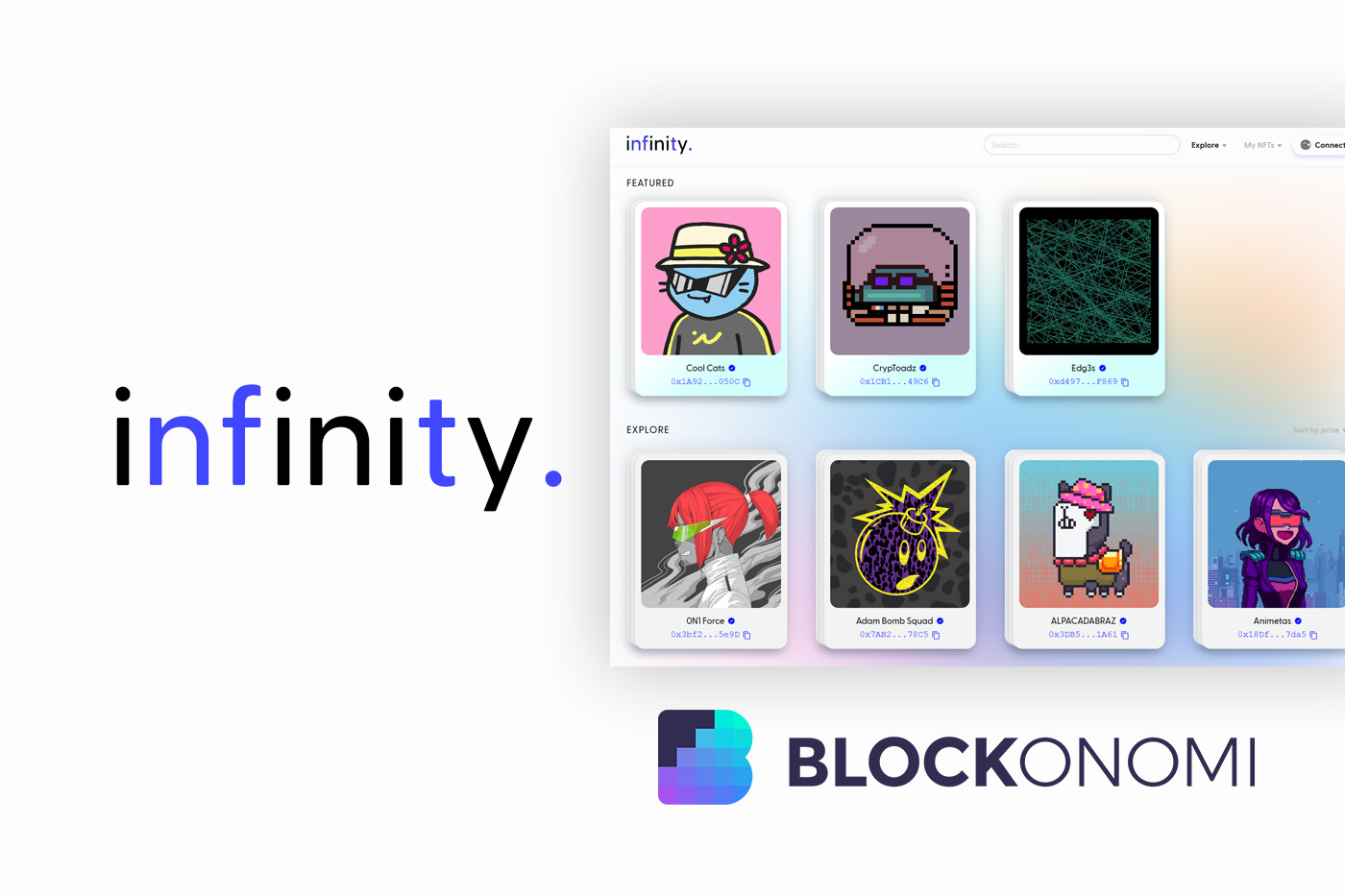

As a result, more and more people are on the lookout for superior alternatives that are free of such issues. Infinity is one such offering, designed from a fork of OpenSea’s code but made to help alleviate all of the above-stated issues while offering users lower transaction fees at 1.5%, versus OpenSea’s 2.5%. Furthermore, it should be noted that all internal transaction fees associated with Infinity go straight to the community-controlled DAO as opposed to OpenSea’s financial model wherein the platform’s operational team gets to keep all of the profits for themselves.

Infinity’s upcoming airdrop program and how to participate in it

Upon launch, Infinity plans on making available a total of 1B tokens exclusively for its fast-growing community of backers, something that is in stark contrast to other platforms like OpenSea that usually set aside a sizable allocation of their native crypto for their respective dev teams, investors and advisors.

While the airdrop was initially open to individuals with a certain purchase transaction volume on OpenSea, Infinity has since expanded the program’s reach to those OpenSea users who have achieved a set sales volume as well — thus allowing users to make a seamless transition to the former.

Lastly, it should be mentioned that all of the airdropped Infinity tokens are designed to satisfy a wide range of functional and utilitarian purposes. For example, they can be used to govern the DAO (depending upon the number of tokens held) as well as be used at a later stage for speculative reasons such as maximizing one’s overall profit ratios.

Looking ahead

As the NFT sector continues to mature and grow, there is no denying that more and more investors will continue to flock to this burgeoning space. Thus, it is of utmost importance that users be provided with platforms that can help them maximize their experience of dealing with this novel asset class.