Introduction

The widespread adoption of bitcoin is a topic that has raised immense expectations for change to monetary systems, governments, and society in general. Over the years, bitcoiners have fiercely defended their belief that bitcoin represents a superior form of money and expressed a large number of hypotheses about possible pathways to the broader adoption of bitcoin. Over the years, Bitcoiners have fiercely defended their belief that bitcoin represents a superior form of money and expressed a large number of hypotheses about possible pathways to the broader adoption of bitcoin. In this article, we investigate the concept of hyperbitcoinization which represents one of the most promising potential developments of our time. By hyperbitcoinization, we mean the process of rapid and irreversible adoption of bitcoin as the primary global monetary reserve.

This article is part of a longer series wherein we outline the views and predictions made by the bitcoin community concerning the prospect of hyperbitcoinization. In our analysis we highlight “transition agents,” i.e., main players, groups of players, or institutions that could accelerate the transition to a bitcoin world. For each topic, we base our arguments on the references collected, and if possible, present data that aims to verify the probability of this outcome. This first article describes top-down scenarios initiated by institutional agents or governments whose influence is expected to trickle down to a wider audience, while a second article will provide an understanding of bottom-up types of initiatives.

The views presented in this article are intended to capture the pulse of the Bitcoin community and remain hypothetical. This is an initial foray into analyzing hypothesized hyperbitcoinization scenarios; we expect that this area will require on-going investigation.

Methodology

The informational resources that most accurately reflect the extent of bitcoin adoption are often private and/or anonymous, but a significant part of the sentiment is publicly available. The methodology employed in this study can be broken down into four steps: collection, content analysis, validation/extrapolation, and convergence.

Step 1: Collection

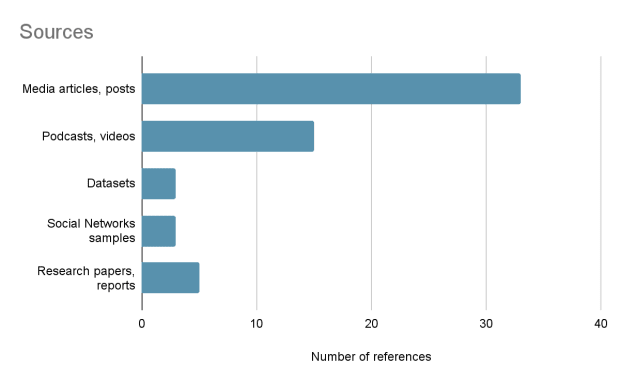

With the aim of identifying agents of transition that may initiate a hyperbitcoinization scenario, we conducted online research of articles, blog posts, podcasts, videos, data sets, tweet samples and research papers from July 2013 to July 2021 that either contained the term “hyperbitcoinization” or referenced the rapid adoption of bitcoin:

Figure 1. Frequency of “hyperbitcoinization” in online materials.

Step 2: Analysis

Through analysis of the articles and transcripts of the videos/podcasts we identified recurring themes highlighting the current social, political, and monetary contexts, the agents or events engendering the transition to the bitcoin world, and only a few projections about the prospect of a hyperbitcoinized world.

Step 3: Validation/Extrapolation

Qualitative data collected in step 1 most often came in the form of predictions discussed within the bitcoin community that have yet to be subjected to critical examination by the wider financial and economic communities. In the following section we present a quantitative analysis that critically examines these hypothesized causal pathways by using micro and macroeconomic data from government, institutional, and public databases to extrapolate the feasibility of such scenarios.

Step 4: Convergence

In the last step, we coded each reference to hyperbitcoinization according to a descriptive theme so that we might present a coherent overview of the current discussion within the Bitcoin community. Despite the great diversity of authors, the analysis that follows shows that hyperbitcoinization predictions converge on a limited number of cases where the transition is triggered by four main groups of actors. These four groups who may influence hyperbitcoinization include central banks, governments, the private sphere, and the Bitcoin community.

Top-Down Scenarios

The financial and economic worlds, crystallized in the fiat system for the last several decades, are unable to perceive credible alternatives to their current reality. According to current economic and financial elites, a different monetary system based on the gold standard or the bitcoin standard would give rise to an anarchic and violent society wherein all concepts of law, economics, or civilization would disappear. Bitcoiners, on the other hand, offer a more optimistic narrative (Keiser and Seiche 2021). Inspired by libertarian thought, they see the government as a superfluous or useless element of society whose interventionism in the monetary field prevents the proper functioning of the market. In this view, the advent of bitcoin would restore monetary stability based on the fixed and transparent production of money.

Figure 2. Hyperbitcoinization scenarios driven by central banks.

Central Banks

Inflation of Money Supply

Out of all the hypotheses made by Bitcoin community members, the most frequent reason cited as a possible trigger for hyperbitcoinization centers on money manipulation by central banks. At several points in history, monetary inflation set off a vicious cycle of decreased purchasing power that culminated in a complete loss of faith in the currency under inflationary pressure. In figure 3, we rank countries based on an annualized increase in broad money between the years 2015–2020.

Figure 3. Annualized monetary inflation (CAGR period 2015–2020). The World Bank. 2021. Broad Money (Current LCU). Washington, D.C.: The World Bank. https://data.worldbank.org/indicator/FM.LBL.BMNY.CN.

Unsurprisingly, figure 3 shows that a large number of countries from this sample suffer from aggressive interventionism with yearly increases of monetary supply higher than 10%. For instance, a 10% annual increase of the money supply implies a decrease in purchasing power of 40% after only five years. The stability and predictability of bitcoin supply has the potential to disrupt the vicious cycle of manipulated monies leading to the loss of faith in the manipulated currency, and elicit the interest of the general population in the hardest form of money ever invented.

Central Bank Digital Currencies

The imminent launch of CBDCs (Central Bank Digital Currencies) by several countries will undoubtedly impact the cryptocurrency industry, but it is not completely clear how this intervention will unravel. Initially we can expect central governments to nudge their populations toward CBDCs through large-scale educational campaigns that will likely have a collateral effect on bitcoin adoption. However, as the limits of centrally-governed monies emerge, we can predict this will push new users into Bitcoin’s arms for at least four of the following reasons:

- The shadow economy is not comprised exclusively of black market trades of illegal substances and trafficking. It encompasses any economic activity or transaction that occurs without being declared to the government. Redman (2020) predicts that bitcoin could only be an alternative to a cashless society that wants to operate under the radar.

- The emergence of CBDCs is raising serious concerns in many democratic countries. A survey conducted by the European Central Bank (ECB) highlighted that, for European citizens and merchants, the privacy of transactions was seen as the most important feature of digital currencies. Even if central banks defend themselves from surveillance, identity management based on “loosely coupled account links, can keep track of necessary data to implement prudent regulation and crack down on money laundering and other criminal offences, as well as easing the workload for commercial banks” (Fan, 2020).

- Several central banks have already announced the development of their coins on public blockchains (South Korea on Klaytn, and the ECB most likely on either Ethereum or Tezos) or on state-controlled blockchain (e.g., China’s digital Yuan). Even if Ethereum is a blockchain with one of the largest ecosystems, its security and decentralization is questionable in comparison to the Bitcoin network. An upcoming shift from the proof-of-work to proof-of-stake consensus algorithm also involves several existential risks that should not be associated with the creation of a currency imposed upon a population.

- The superiority of bitcoin over other currencies has long been argued by the Bitcoin community. Recently, several CBDC projects carried out by central banks confirmed this superiority and recalled the importance of a fixed monetary supply, a censorship-resistant protocol, or of pseudonymous transactions. The most advanced experiences in the field suggest that the notion of programmable money has already been tested in several forms. By issuing coupons whose use is limited to certain sectors, the local government of Chengdu (China) encourages its population to favor public transport. Even if at first glance this type of initiative seems laudable, it quickly gives a glimpse of the kinds of abuses that such a system could generate. In addition, another initiative deserving of attention allows the central government to increase money velocity by issuing e-CNYs whose validity is limited in time. Even if this feature seems to have been deployed only as a pilot project, it raises several questions about currency fungibility and, most importantly, on the immense controlling power that any central bank could have by despoiling the population.

Government

One of the most common hyperbitcoinization hypotheses is the adoption of bitcoin initiated by governments. Figure 4 describes several prospective scenarios hypothesized by the Bitcoin community that have yet to occur.

Figure 4. Hyperbitcoinization scenarios driven by governments.

State Hoarding Of Bitcoin Scenario

In this scenario, the transition toward a bitcoin standard unfolds in distinct ways whether we look at it from the angle of individuals or governments. In “Layered Money,” Nik Bhatia (2021) predicts that governments will progressively build a healthier monetary system on top of the hardest money ever created: bitcoin.

Figure 5. Nik Bhatia. 2021. “Layered Money: From Gold and Dollars to Bitcoin and Central Bank Digital Currencies.” Nikhil Bhatia.

Several countries have reported possession of bitcoin after seizing it from criminal activities, but no country has announced a specific strategy for hoarding digital assets as a reserve currency. In this context, El Salvador is an outlier in adopting bitcoin. The acceptance of bitcoin as a legal tender in El Salvador could be interpreted as an isolated political decision, but the successive announcements by the government to first implement a national mining policy with the BigBlock Datacenter and subsequently to hoard BTC, confirm the execution of a broader bitcoin strategy in the country.

“Sputnik” Trade Scenario

For decades, the dollar’s status as a global reserve currency has given the U.S. the privilege to impose sanctions on a global scale (figure 6).

Figure 6. Map of countries sanctioned by U.S. Wikimedia.org, JojotoRudess, CC BY-SA 4.0

Predictions about the demise of the hegemonic dollar are not new, but recently new narratives have appeared speculating on how the adoption of bitcoin could contribute to the decline of the U.S. dollar (Clemente 2021). If two countries suffering under U.S. sanctions start using bitcoin as a settlement layer to circumvent these sanctions, doing so may provide the same kind of rude awakening for world governments as Sputnik had for U.S. space policy in the 1960s. From that point, it could set an alternative path for other countries to replicate. Iran, whose economy has been under embargo since 1979, sits on a large reserve of fossil fuel energy that could either be exported against a payment in bitcoin or by selling hashrate. The Iranian currency could become one of the most sought after global currencies and reposition the country on the pedestal of sound money (Keiser and Seiche 2021).

El Salvador Case

The announcement made by the president of El Salvador to accept Bitcoin as legal tender was greeted as a consecration by the Bitcoin community in the word. El Salvador, whose economy has been hit hard by the Covid-19 pandemic, has long dealt with high crime rates linked to drug trafficking. The country’s dependence on the U.S. is high both in terms of exports and expatriate remittances (figure 7).

Figure 7. Total cost of transaction for remittance of $200 based on World Bank data. World Bank, Remittance Prices Worldwide, available at remittanceprices.worldbank.org,

The bill proposed by President Nayib Bukele to the legislative assembly aims to position the country on the rails of prosperity by creating job opportunities, driving more inclusion, and boosting the economy. Even if this bill created a lot of excitement among Bitcoiners, forced money law — in this case bitcoin as a legal tender — diverges from the Bitcoin community’s central values of freedom, voluntarism, and free competition (Koning 2021).

This initiative provoked mixed reactions from global financial institutions. As expected, the International Monetary Fund expressed serious concern about the adoption of bitcoin as legal tender by the Central American country and pronounced that the bill presented a number of macroeconomic, financial, and legal risks. The Central American Bank for Economic Integration (CABEI), whose mission is to promote the economic integration and social development of the Central American region, took a more constructive and pragmatic approach. They offered technical assistance to the country to help with the implementation of the new system.

Since the announcement of the bill, officials from Paraguay, Panama, and Mexico have expressed their intentions to present crypto-related bills in the coming months to duplicate the process initiated by President Bukele.

If the experience in El Salvador, whose dependence on remittances is estimated at 24% of Gross Domestic Product, translates into an improvement in economic conditions, many countries beyond Central America could be incentivized to follow the same path as shown on the following map:

Figure 8. World Bank staff estimates of personal remittance received (% GDP) for Africa & Asia based on IMF balance of payments data, and World Bank and OECD GDP estimates.

On an exploratory basis, we estimated the impact on countries’ GDP if current remittance solutions are replaced by Lightning Network (LN) payments. As part of this estimate, we assumed a zero cost LN transaction and remittance cost equivalent to the average observed for transactions of $200 in each country. Figure 9 shows that the economic impact would be particularly beneficial for countries whose dependence on foreign capital inflows is greater than 20%.

Figure 9. World Bank staff estimates of the impact of zero-cost transactions on country GDP (%) based on IMF balance of payments data, and World Bank and OECD GDP estimates.

Conclusion

This study synthesized hyperbitcoinization scenarios and identified key agents that may initiate this transition. We categorized these scenarios into two groups: (1) top-down initiatives stemming from institutional actors such as central banks and governments, and (2) bottom-up initiatives emerging from the private sphere and Bitcoin communities. This first article presented an exhaustive analysis of the “top-down” scenarios, however the current state of adoption of Bitcoin technology does not permit drawing definitive conclusions about the influence of a particular agent. Rather this article serves as a foundational framework to continue our analysis of these prospective scenarios over time. The decentralized nature of Bitcoin is often in tension with the priorities of governments and financial organizations which are centralized, but this study shows how these institutions may play a major role — intentionally or unintentionally — in a mass adoption of bitcoin.

In a second article, we will present bottom-up scenarios driven by private and individual actors as a comparison to the top-down pathways.

This is a guest post by Alexandre Bussutil. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

Bibliography

Alden, L., & Posch, A. (Aug 6, 2020). Lyn Alden “Bullish On Bitcoin – A Strategic Value Investors View” https://www.youtube.com/watch?v=_D-11qqH4cM

Clemente III, W. (Jan 24, 2021). “Hyperbitcoinization. The Path To Becoming The World’s Dominant Form Of Money” https://www.bitrawr.com/hyperbitcoinization

Fan, Y. (April 1, 2020). “Some Thoughts On CBDC Operations In China” https://www.centralbanking.com/fintech/cbdc/7511376/some-thoughts-on-cbdc-operations-in-china

Keiser, M., & Seiche, L. (Jan 8, 2021). ES MCCVR 2020: Max Keiser & Lina Seiche – “Hyperbitcoinization: Maximalist Utopia or Inevitable Endgame?” https://www.youtube.com/watch?v=kese9tMFgvc

Koning, J. (June 16, 2021). “Hyperbitcoinization: By Choice or by Force?” American Research for Economic Research. https://www.aier.org/article/hyperbitcoinization-by-choice-or-by-force/

Minting Coins. (Sept 9, 2017) #88 “Hyperbitcoinization + SEC Meeting, Overstock, Google, & Byzantium Metropolis” youtube.com. https://www.youtube.com/watch?v=PgjmSGjjRvo

Redman, J. (April 6, 2020). “Hyperbitcoinization: Visions of Bitcoin Fueling the Post Covid-19 Shadow Economy” https://news.bitcoin.com/hyperbitcoinization-post-covid-19-shadow-economy/

Suberg, W., & Draper, T. (March 3, 2021). “Netflix ‘Might’ Be Next Fortune 100 Firm To Buy Bitcoin — Tim Draper”https://cointelegraph.com/news/netflix-might-be-next-fortune-100-firm-to-buy-bitcoin-tim-draper