This just in– a cryptocurrency expert predicts Bitcoin’s price will probably either go up or down in the indefinite future.

If you’ve grown tired of baseless financial “guru” predictions on cryptocurrency price action, you’re in the right place.

This article right here is what we gather to be the bull case for Bitcoin as it relates to this present moment in time, Q4 2023.

When is the next bitcoin bull run? Only time will tell– our goal is to aggregate the most significant events that could contribute to a Bitcoin bull run.

- Like a trustworthy weatherman, we’ll explore a forecast of the current macroeconomic and political climates as they relate to Bitcoin sentiment.

- We’ll look at prior BTC events, such as the Bitcoin Halvening, and other fundamental inclinations towards a Bitcoin bull run.

- We’ll also keep a running log of favorable “micro” events and industry happenings that signal good news for Bitcoin – think of it like a Venus fly trap for good BTC news.

There are a few things we won’t do, too.

-

- We won’t make this a BTC pep rally. There is an obvious bias here; we’re a crypto publication– we’re existentially tied to the success of cryptocurrency. We’ll add our meditations on each topic below, but that doesn’t mean we’re going to pretend like bad news isn’t bad news– check out our evil twin-piece Bear Case for Bitcoin.

- We won’t make a price prediction. We are but humble aggregators of data and adding insights gained from being in the industry for close to a decade.

- We won’t provide financial advice. You know, the standard financial magazine disclaimer– if you buy Bitcoin and it goes to zero, that’s on you. Consult with a licensed financial advisor; send them this article and get their opinion.

Let’s dive into the most recent news and insights that could contribute to the next bitcoin bull market.

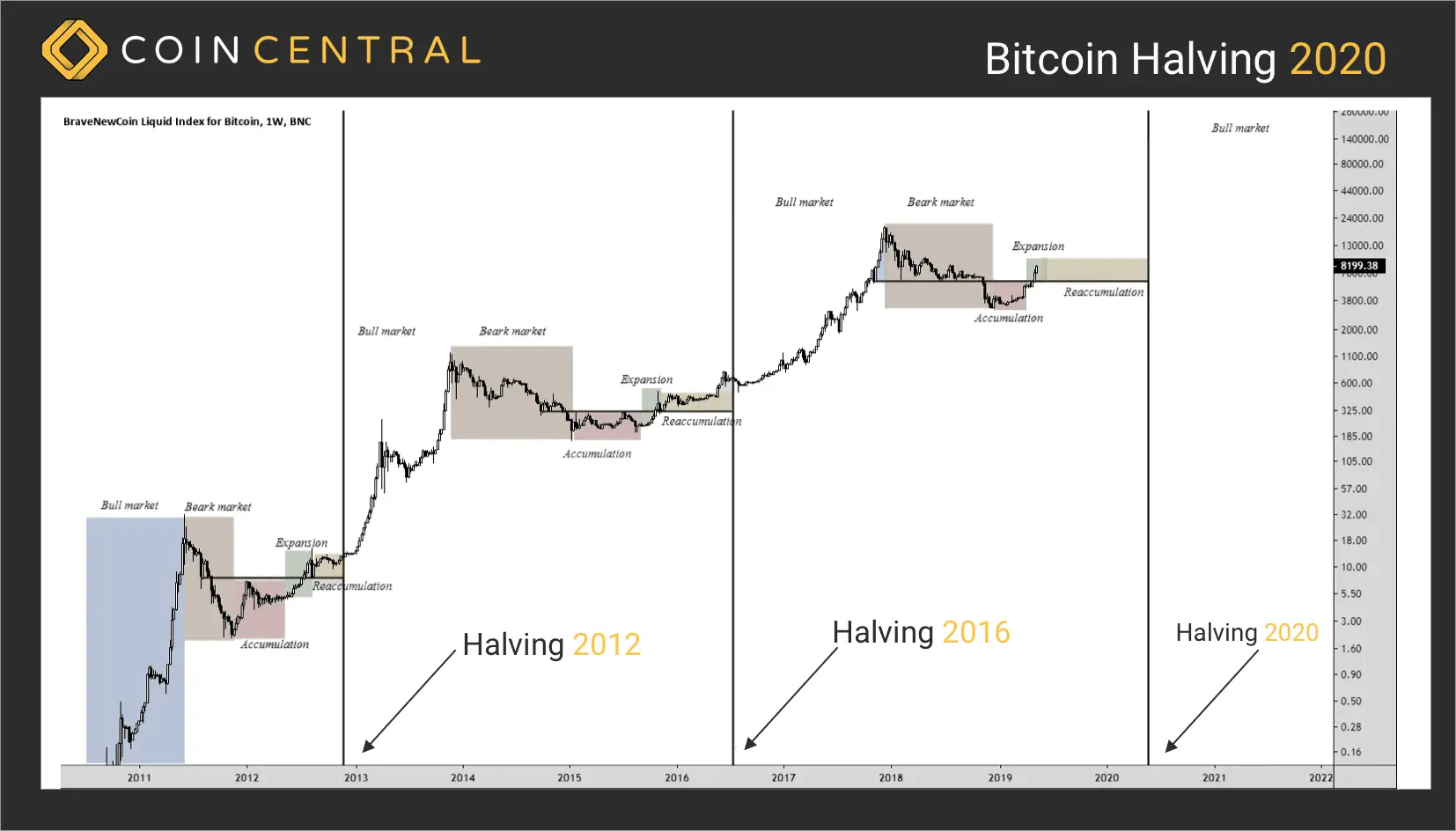

1. The Much-Anticipated Bitcoin Halving Event

What happens every 4 years that doesn’t disappoint half the country? It’s not a Presidential Election, it’s the Bitcoin Halving event, baby.

It’s not timed to happen precisely every 4 years (don’t let our joke give you the wrong impression), the Bitcoin Halving (or halvening) is based on Bitcoin’s programming. In every halving event, mining rewards are cut in half to protect Bitcoin from inflation.

For example, prior to the 2020 halving, the miner who validated the next block received 12.5 BTC as a reward. Post-halving, the reward dropped to 6.25 BTC.

Sometime in 2024 (estimated April 2024), Blocks 740,001 onward will earn 3.125 BTC in rewards.

In theory, with fewer bitcoins entering circulation, the asset is perceived as more valuable. Whether or not that’s a direct explanation, Bitcoin tends to experience a bull run after every halving; it’s not as much a mathematical guarantee as much as the market tending to go bananas over the event.

- In 2012, BTC jumped over 350% leading up to the halving, and over 8,000% in the subsequent year.

- In 2016, BTC climbed 142% leading up to the halving, and over 284% in the subsequent year.

- In 2020, BTC grew 17% leading up to the halving, and over 559% in the subsequent year.

Statistically, things look good for a Bitcoin bull run at BTC’s next halving. However, the fine print– past performance is no guarantee of future results. Don’t assume a BTC bull run is as sure as the sun rising tomorrow.

2. Spot BTC ETF Approval

“All we need is a BTC ETF, and the sweet, sweet institutional money will finally flow in!”

Ah, yes, the two acronyms have given the crypto world hopium for years. The only difference between now and when the first Bitcoin Exchange Traded Fund application was submitted is that the reality of BTC ETF is actually palpable.

A bitcoin ETF would delegate the purchasing and storage of BTC to qualified custodians– not the Celsius Networks and FTXs of the world. Actual adults in the room.

Some of the world’s largest financial institutions have already filed for a Bitcoin ETF: BlackRock ($9T in AUM), Fidelity ($4.5T), Franklin Templeton ($1.5T), Invesco ($1.5T), WisdomTree ($87B), VanEck ($77.8B), ProShares ($65B), Grayscale: ($50B), GlobalX ($51B in AUM) and more.

For perspective, Bitcoin’s current market cap is around $500B, its highest at $1.22T.

The favored horse in the race is BlackRock, which has been a powerhouse financial firm with a 575-1 record of getting its ETFs approved.

Why would a spot Bitcoin ETF contribute to a Bitcoin bull run?

The ETF structure is a familiar and regulated investment vehicle institutional investors are very familiar with, leading everyone from your great-aunt Bertha who wants to buy BTC to hedge funds and pension funds.

A broader base of investors would gain access to a digital asset they may want to avoid being responsible for holding directly.

The first bitcoin futures ETF (the ProShares Bitcoin Strategy ETF) was approved in October 2021, and perhaps not totally coincidentally, Bitcoin’s price climbed to an all-time high north of $69,000 in November 2021. Rather than trading on futures contracts for Bitcoin’s worth, the pending “spot” Bitcoin ETF would trade its live price.

This sudden meaningful surge in demand (*nudges* more supply and demand, cool, right?) could lead to a price rally.

Some analysts are comparing a BTC ETF to the first gold ETFs. PDR Gold Shares, the first gold ETF listed on the NYSE in November 2004, saw over $1 billion in inflows in its first days. The price of Gold hit an all-time high in subsequent years.

3. People Keep Losing Bitcoins

The number of lost bitcoins isn’t exactly a sudden event, but it does provide some helpful tailwinds. We like straightforward concepts like supply and demand.

When a fat BTC wallet is unfortunately lost, they’re essentially as good as gone forever. There isn’t a digital asset claims office, nor is more BTC suddenly printed to compensate for the loss. Optimistically, you could think of each lost bitcoin as an indirect donation to the bitcoin holders around the world.

We can only speculate on how much Bitcoin is actually lost. A quick Google search gives a range of anywhere between 20% to 29% of current Bitcoin lost– either from user error such as blasting off BTC into an invalid address, losing their private key, or a wallet going down with the ship when someone passes away.

That’s about 4 million BTC on the low end– about $100 billion– off the table forever.

Whether that’s someone losing hundreds of millions of BTC in a landfill or a billionaire dying and losing access to their wallet, it decreases the supply, but the demand stays the same– less the dead person.

However, bitcoin’s price is irrational– rarely do we collectively “mark to market” the true number of accessible bitcoins, let alone even know what the number is. Who’s to say that the market hasn’t already “priced in” the ambiguous number of lost bitcoin.

But, on a long enough time horizon, we can only assume more BTC will, unfortunately, be lost, meaning there will already be far less BTC than the actual hard cap of 21 million BTC.

In other words, supply will only continue to go down due to user error and death, whereas there’s nothing stopping demand from breaking past its current ceiling.

We can only speculate on how much Bitcoin is actually lost. A quick Google search gives a range of anywhere between 20% to 29% of current Bitcoin lost– either user error resulting in a lost private yet blasted off into the abyss and sent to an invalid address or going down with the ship when someone passes away.

That’s about 4 million BTC on the low end– about $100 billion– off the table forever.

Whether that’s someone losing hundreds of millions of BTC in a landfill or a billionaire dying and losing access to their wallet, it decreases the supply, but the demand stays the same– less the dead person.

However, bitcoin’s price is irrational– rarely do we collectively “mark to market” the number of accessible bitcoins, let alone even know what the number is.

But, on a long enough time horizon, we can only assume more BTC will, unfortunately, be lost, decreasing the actual hard cap of 21 million BTC into something much smaller. In contrast, the demand isn’t inhibited from breaking past its current ceiling.

4. Irrational Markets, Rational Fundamentals

“Markets can remain irrational longer than you can remain solvent.”

– John Maynard Keynes (we often mix his name up with Tool frontman Maynard James Keenan)

…and cryptocurrency is perhaps the most irrational. Anyone prophesizing they can predict a cryptocurrency’s price accurately by a certain date is more a wishful thinker than an oracle.

Asset prices, or at least how most of the crypto generation has come to understand them in a low-interest-rate economy, are tied to the idea of the asset rather than its fundamental value.

Bitcoin’s price ebbs and flows around its value. It’s affected by many non-Bitcoin things, such as interest rates and uncertainty related to the greater economy. Conversely, we’ve seen its price jump in reaction to news that a company like Tesla plans to buy more BTC.

Heck, we’d have likely seen a double-digit percentage gain in 2017 if Warren Buffett said so much as “Bitcoin seems cool.”

As outlined in Satoshi’s whitepaper, Bitcoin is meant to be a pure peer-to-peer version of electronic cash to asend and receivefunds without going through a financial institution.

Its anti-inflationary design is the bedrock of the argument that Bitcoin is a better store of value than government-controlled inflationary currencies.

A bear market may have scared off some BTC holders, but Bitcoin’s value proposition is more significant than ever. Rampant USD inflation, external threats to the U.S. Dollar, growing national debt, and our historic tendency to print our way out of it all make BTC look better in comparison.

Ethereum’s bull case is a different beast from Bitcoin. If Ethereum, with a market cap of about $200 billion, were a publicly traded company, it would be ranked as one of the world’s 50 highest market cap companies but still worth less than companies like Alibaba, Cisco, Home Depot, and Bank of America.

Don’t get us wrong, we love building some shelves IRL, but many would argue Ethereum’s fundamentals (such as its capability to create anything from tokenized games to run an entire decentralized financial system) are more significant than “How Doers Get More Done.”

Just for the price of one good crypto news event, you can feed a starving Bitcoin optimist for a full day!

The following list of bullish crypto events should last you at least a week.

- September 2023: Visa partnered with Solana to expand its stablecoin settlement capabilities.

- September 2023: Grab, Uber;’s primary competitor in Asia with over 180 million users, unveiled its new web3 wallets, allowing users to pay for things in crypto. It began rolling out its wallet to users in Singapore in late September.

- September 2023: Telegram launches its self-custodial crypto wallet for its over 800 million users.

- August 2023: Shopify integrates Solana Pay to enable USDC payments.

- August 2023: Grayscale wins an appeal against the SEC; the U.S. District of Columbia Court of Appeals ruled that the SEC was wrong to reject its application for a Bitcoin ETF.

- July 2023: Ripple partially wins the lawsuit against the SEC. In 2020, the SEC filed a suit against Ripple and its execs, alleging it failed to register its XRP as a security. In July 2023, the U.S. District Court of the Southern District of New York ruled that Ripple’s XRP tokens on exchanges and through algorithms actually did not constitute investment contracts. However, the institutional sale of the tokens did violate some federal securities laws, hence the partial win.

Did we miss something? Probably! Email us at [email protected] if you think something should be added to the list.

That’s Old News, But Still Noteworthy

As this article aims to be “always evergreen,” we’ll reserve this section for news that doesn’t seem immediately relevant but still helps paint the picture of the overall direction.

Final Thoughts: When is the Next Bull Run?

As a wise pig once said, that’s all folks.

At least for now.

Bookmark this article for ongoing bitcoin bull run predictions and subscribe to our newsletter.

With our finger on the pulse of the fundamentals and keeping an eye on how corporations and people continue to use cryptocurrency like Bitcoin, we believe Bitcoin’s future is bright despite an otherwise troublesome macroenvironment.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.