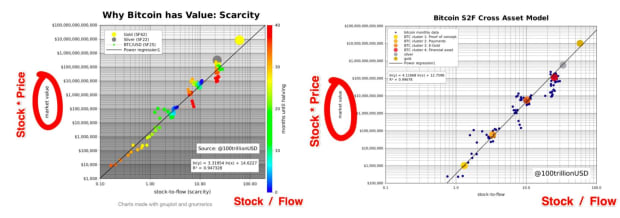

In March 2019, an anonymous individual by the pseudonym “PlanB” astonished investors when he published “Modeling Bitcoin Value with Scarcity,” and introduced his now famous Stock-to-Flow (S2F) model. The model predicted exponential growth of the bitcoin market value, with what purported to be sound scientific methods. A year later, he introduced the Stock-to-Flow Cross Asset (S2FX) model, which includes gold, silver, diamond and real estate data. As we will see below, PlanB’s models are scientifically invalid and don’t have the confidence level he claims they do.

According to his website, PlanB is “a former institutional investor with 25 years of experience in financial markets. He has a legal and quantitative finance background and has always been fascinated by modeling risk and return.” Note that he doesn’t claim to have expertise in modeling risk and return. This will become important, shortly, as we will quickly see that the S2F/S2FX models could not have been formulated by anyone with deep knowledge of statistics modeling.

According to PlanB’s March 2019 article:

“The linear regression function: ln(market value) = 3.3 * ln(SF)+14.6

.. can be written as a power law function: market value = exp(14.6) * SF ^ 3.3

The possibility of a power law with 95% R2 over 8 orders of magnitude, adds confidence that the main driver of bitcoin value is correctly captured with SF.”

As impressive as that may sound, PlanB has made a remedial error here. Notice how the function says “market value” equals a function of Stock-to-Flow? This is a tautology and therefore a statistically invalid model, for the simple reason that “market value” decomposes to “Stock * Price” while “Stock / Flow” is on the other side of the equation.

In layman’s terms PlanB is essentially asserting that “Stock is a function of Stock.” A tautology is a trivial statement that is true under any circumstances. It’s like saying a banana is a kind of banana. Of course Stock is a function of Stock. This is why the data fits, but is scientifically worthless. Tautologies are true but do not tell us anything useful. Rather, they are true because of the meanings of the terms.

This means the model is autocorrelated (i.e. invalid). When you adjust for that, the R-Squared (R2) value is zero. Thus, scientifically speaking, Stock-to-Flow is nonsensical and cannot be used to model price.

“It shows high correlation [because] it uses the same term in each axis (stock), and when you take the log of two terms with the same variable you ADD it. When one (stock) is much more volatile, it dominates. The model is autocorrelated. Does not need S2F at all. Just price vs time.”—Cory Klippsten

Furthermore, the architecture of his models shows a lack of understanding of statistical modeling, nevermind that the model doesn’t even incorporate demand. To make the models valid he would have to detrend the time series. Their innovations, the little inconsistencies, should contain information about the other side of the equation. Without detrending, one gets spurious results. Just regressing two sloped lines against each other creates a semblance of correlation that just isn’t there.

PlanB’s Stock-to-Flow Cross Asset (S2FX) model suffers from the same basic mistake and has additional issues. PlanB claims the S2FX model leaves out time for bitcoin, but this is false as his Bitcoin phases are a function of time. The clusters equal halving periods and one can already draw out the next phases on the X-axis. The other assets are cherry picked and even the values for those assets are cherry picked.

For a more detailed breakdown of PlanB’s bad math, read btconometrics’s Bitcoin and Stock to Flow critique where he shows the fallacious statistics behind PlanB’s models and illustrates the fallacy of bamboozling statistics. This is argumentum verbosium — otherwise known as proof by verbosity or proof by intimidation.

“In this article I will show you why stock to flow is nothing but a flight of fancy — a fairytale or a fantasy bolstered by emotional support from irrational actors, a lack of broad-scale mathematical knowledge and proof by verbosity.” (btconometrics)

PlanB has rebuffed valid criticism saying the model can be restated with price using completely different parameters that avoid the tautology. However, these alternative parameters are just arbitrary numbers that he changes from time to time. To understand why this is a problem, we can compare it to the famous Bitcoin Rainbow Chart. The Rainbow Chart was created by Über Holger and it has a highly visible disclaimer on it which says:

“The color bands follow a logarithmic regression (introduced by Bitcointalk User trolololo in 2014), but are otherwise completely arbitrary and without any scientific basis. We never change them though. In other words: It will only be correct until one day it isn’t anymore.”

Holger is completely honest and transparent about the Rainbow Chart. It is not intended to be anything more than a wild guess. It’s not pretending to be scientific.

Contrast this to PlanB, who has gone out of his way to falsely claim a scientific basis for his models in his writings and on dozens of podcast shows. On these shows he claims to welcome criticism but his Twitter account tells a different story — anyone who points out a flaw, potential problem, has a valid question or even “Likes” a valid inquiry into the validity of his assertions is blocked.

PlanB says he blocks people for “noise control” but assures his followers that he welcomes valid debate and criticism. However, his actions on Twitter tell a different story. Individuals who criticize PlanB’s models in good faith are blocked by PlanB. Inquiring why S2FX phases are aligned with halvings, and therefore appear as if to be a time series, quickly results in a block. PlanB blocks those who state opposing opinions. He blocks people who “Like” tweets with genuine criticisms. Followers have been blocked for privately messaging him a serious question. He has even blocked people who change their Twitter name, in jest, to PlanC.

This is not the behavior that one would expect from an individual with genuine expertise in quantitative finance or who has respect for the scientific method. If PlanB wants to honestly claim that his models have a scientific R2 value in the high 90s, then he cannot be blocking and censoring valid criticism that shows otherwise.

What It Means To Be A “Useful” Model

PlanB often repeats George Box’s assertion that, “All models are wrong, but some are useful.” He misuses the quote. Box was referring to scientific models that offer testable hypotheses, not tautologies. In an article on the subject for Nature, Alexander J. Stewart explains:

“But the purpose of a model is always to clarify our understanding of what we are studying. That sounds straightforward, but it’s not, because clarity of understanding can only be assessed in hindsight. A model must help us formulate testable hypotheses in a way that moves a field forward, perhaps by pointing us to a new idea that finds empirical support, by allowing us to throw out an old idea, or by making a more precise quantitative prediction. […] Bad models aren’t wrong, they’re tautological”

PlanB’s ardent followers often retort, “But, Einstein and Newton made mistakes! His model will work until it doesn’t.” This misses the point and it is insulting to scientists like Einstein and Newton. Yes,it’s true that Newton and Einstein were fallible, but as followers of the scientific method, they welcomed criticism and admitted their mistakes. PlanB avoids both.

Einstein and Newton’s revolutionary models were groundbreaking hypotheses that clarified our understanding of the universe. Neither are famous for postulating tautologies. Newton said forces act on matter. Einstein said matter is energy and energy is matter. PlanB made the nonsensical claim that stock is a function of stock. That’s not a useful hypothesis or model. Bitcoiners who claim to fight against snake oil salesmanship and shitcoinery should be demanding better.

Tell Me The Good News

Now that we know that the S2F/S2FX models are just lines on a chart with no scientific basis, we can set those models aside and move on and focus our energy on better hypotheses that can be tested and potentially change the way we think about bitcoin. We don’t have to shackle our expectations to PlanB’s arbitrary price schedule.

Those who fell for PlanB’s argumentum verbosium can move on and gain real conviction in Bitcoin by learning about its properties, its network effects and what sets it apart from all other projects. Bitcoin has a bright future and the sooner we move away from bad models, the sooner we can come closer to understanding it.

This is a guest post by Level39. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.